by Conrad Meertins | Feb 27, 2024 | Market Trends, Valuation

In the realm of real estate, the synergy between homeowners, realtors, and appraisers is not just beneficial; it’s essential.

Drawing from Stephen Covey’s 6th habit, “Synergize”, we see the immense value in collaborative efforts, especially when it comes to the precise task of home valuation. This principle underscores the strength found in teaming up, highlighting how collective inputs lead to superior outcomes.

The Unique Roles in Real Estate Transactions

Realtors are the navigators of the real estate transaction process, masters at brokering deals to ensure fairness and optimal outcomes for their clients. With an in-depth knowledge of market areas honed over years, they are pivotal in guiding homeowners through the complexities of selling or buying a home.

Appraisers, on the other hand, bring a different set of skills to the table. As valuation experts, they delve into the nitty-gritty details of property value, armed with data and trends to pinpoint the most accurate market value.

Their expertise becomes particularly crucial in fluctuating markets, where accurate valuations can make or break a deal.

The Synergy in Action: A Real-World Scenario

Consider a homeowner eager to sell their property. They believe their home is worth $350,000, while their realtor, considering current market dynamics, suggests a starting point of $300,000.

Here, the realtor could either acquiesce to the homeowner’s wishes or provide detailed market insights to align expectations. This is where an appraiser’s expertise becomes invaluable.

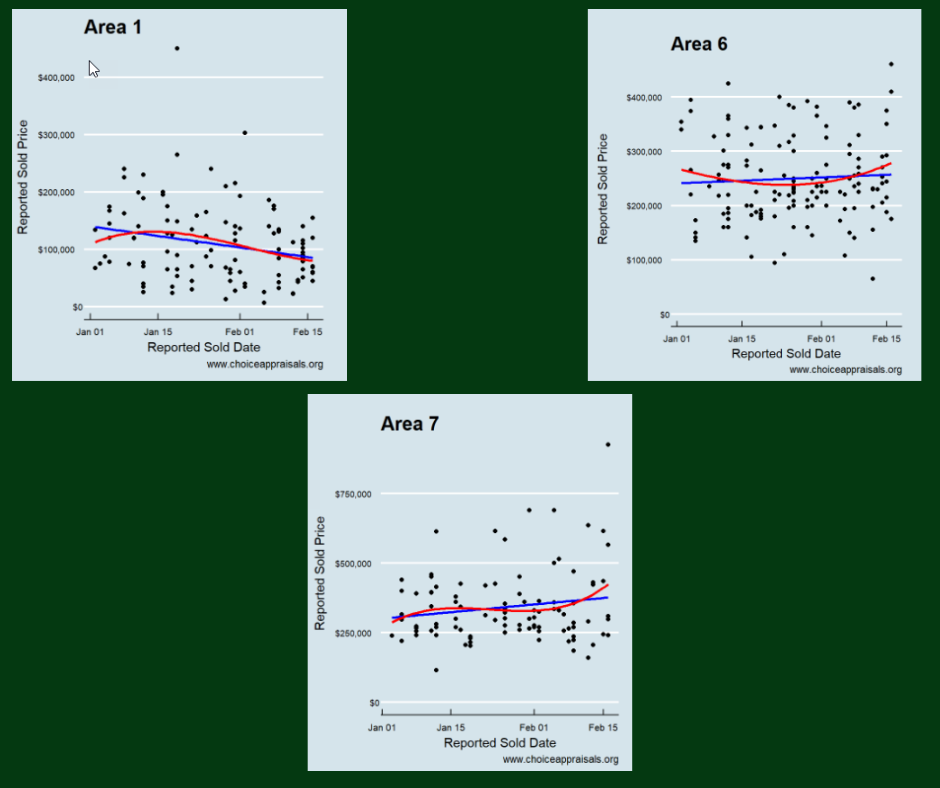

Data and Evidence: Understanding Louisville’s Market

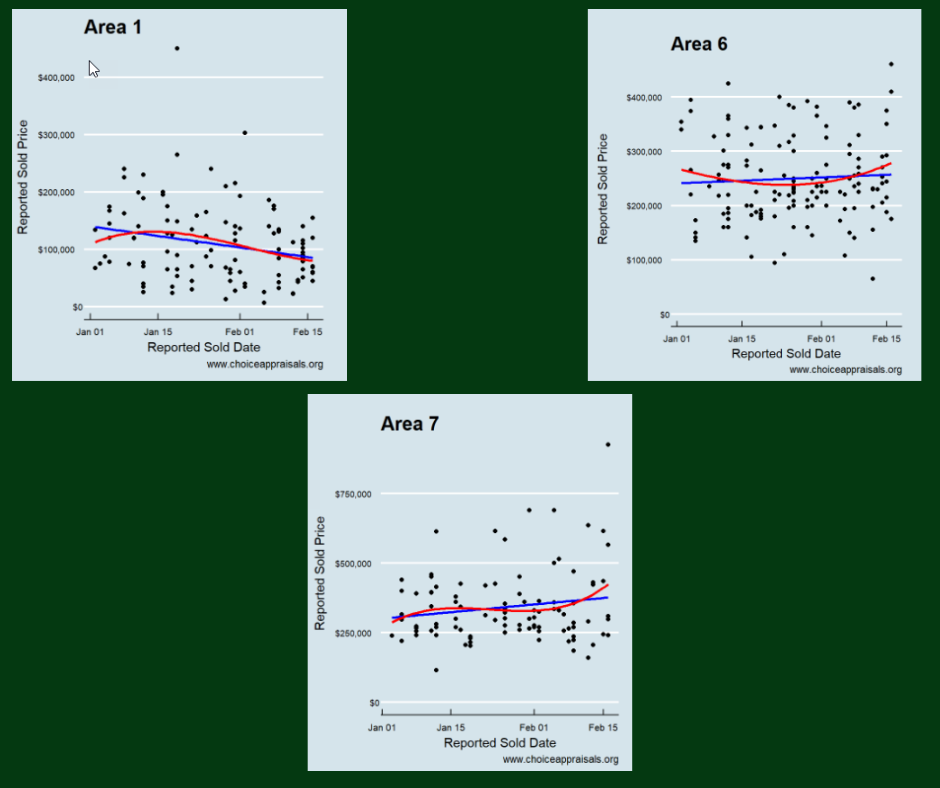

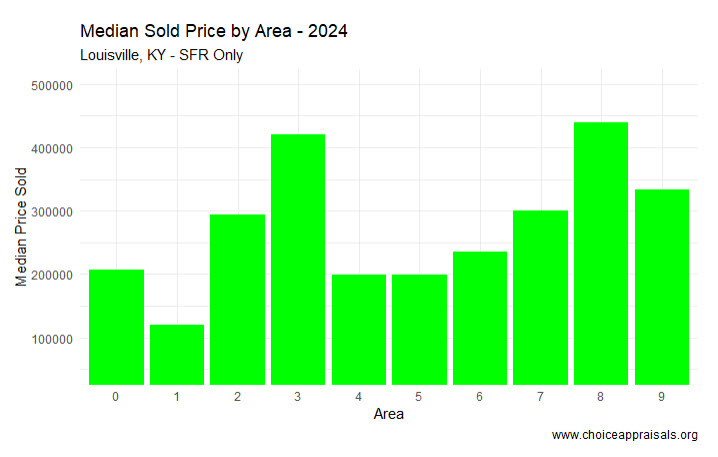

The above graph highlights the trend for homes that sold in MLS Area 1, Area 6, and Area 7. While Area 1 experienced a decline in sales prices with 114 sales, Areas 6 and 7 showed an uptick, boasting 145 and 96 sales, respectively.

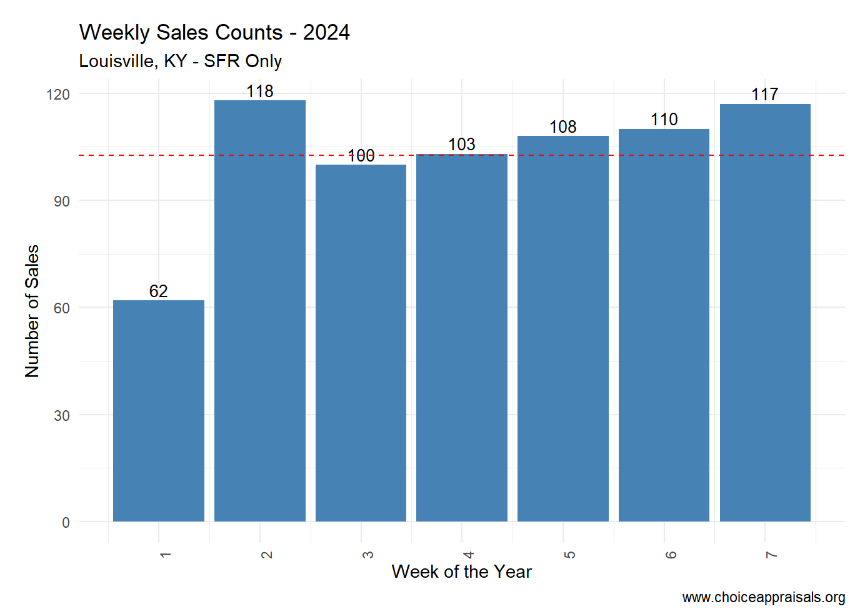

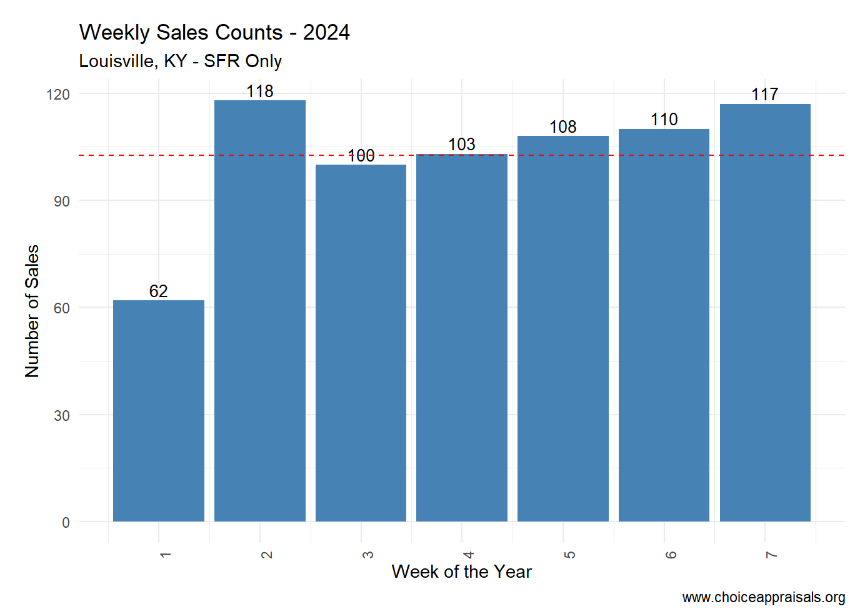

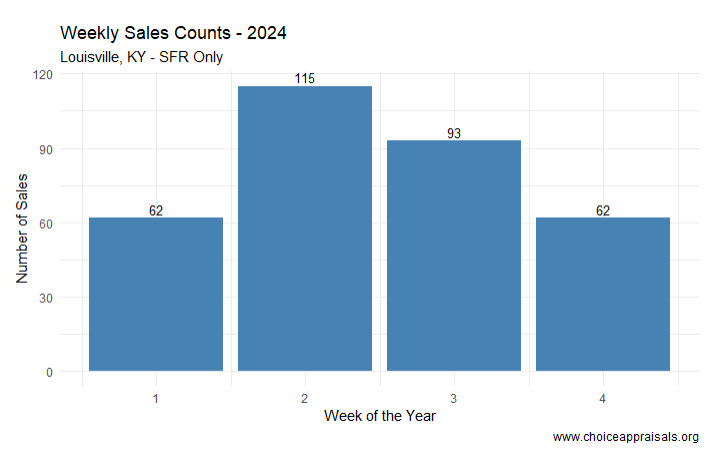

The above graph highlights the weekly volume of sales in Louisville, KY. since week one of 2024

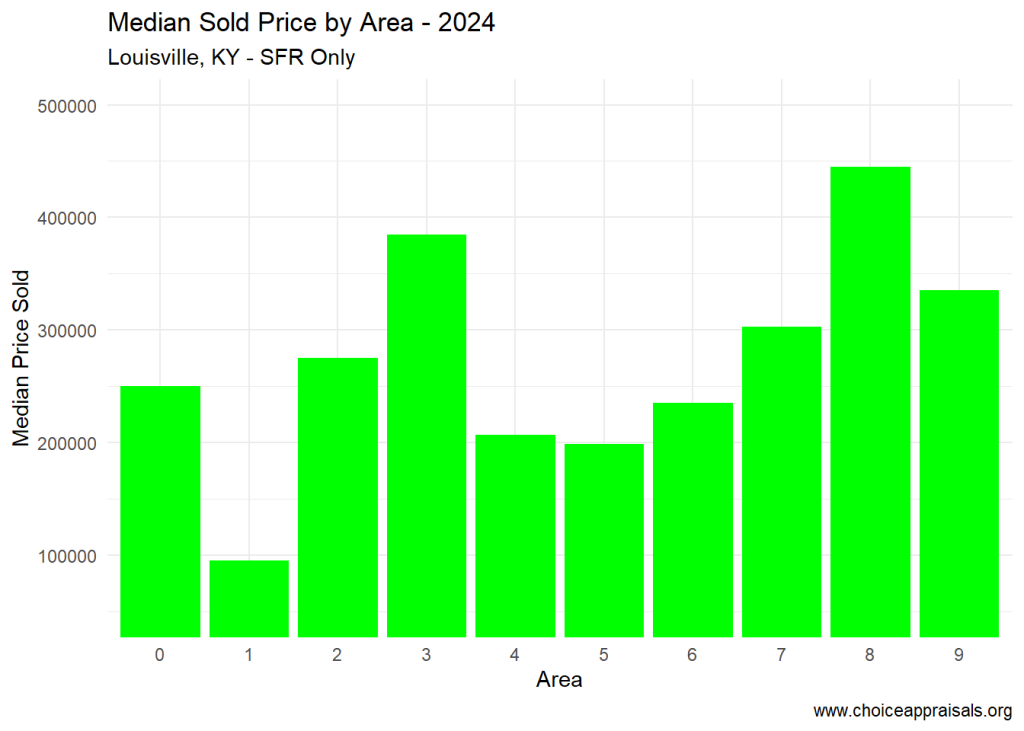

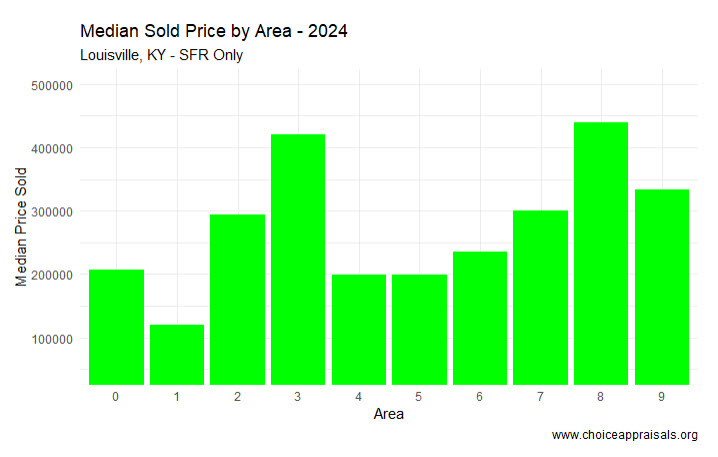

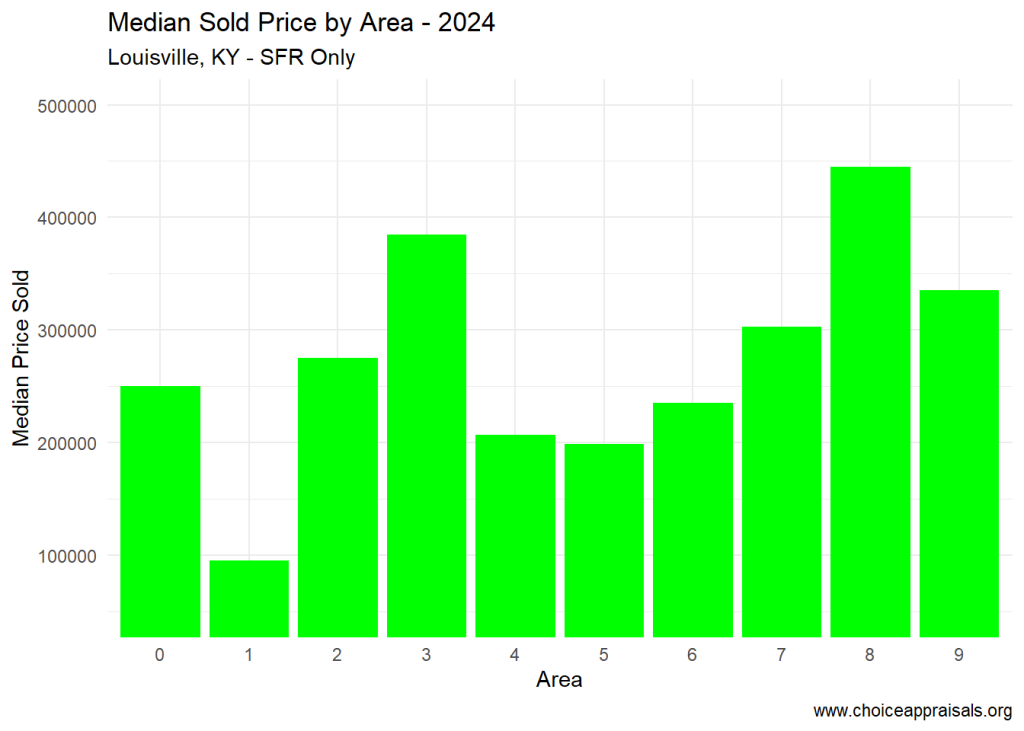

The above graph illustrates the median sale price for each MLS area in Louisville, KY over the first 7 weeks of 2024. As can be seen from the above charts, in week 7 of 2024, Louisville’s real estate market presented varied trends across its MLS areas.

The average days on market hovered between 20 and 25, with an overall median sales price of $249,000 across Louisville.

However, disparities exist, with Area 3 approaching a median of $400K and Area 8 nearing $450K. Such granular data is crucial for appraisers and realtors alike to provide homeowners with accurate, realistic valuations.

Leveraging Synergy for Success

When realtors and appraisers collaborate, sharing insights and data, they ensure homeowners receive the most accurate valuation, tailored to the nuanced dynamics of their specific MLS area.

This synergy not only enhances trust among all parties but also secures a smoother transaction process, grounded in realism and mutual understanding.

Embrace Collaboration

For homeowners, understanding the value of your home is more nuanced than it might appear. Engage both your realtor and a local Louisville appraiser in the conversation.

Realtors, don’t hesitate to bolster your market knowledge with insights from appraisers. Appraisers, your expertise is more critical than ever in today’s data-rich age—collaborate with realtors to demystify market trends for homeowners.

The Winning Formula

Synergy, as Stephen Covey highlighted, is about producing a collective outcome that surpasses what individuals could achieve alone.

In Louisville’s diverse real estate landscape, embracing this collaborative spirit ensures that homeowners, realtors, and appraisers alike can navigate the valuation process with confidence, accuracy, and success.

Let’s work together, leveraging our unique strengths for the common goal of transparent, fair, and effective real estate transactions. Go Louisville, where synergy is indeed where it’s at!

by Conrad Meertins | Jan 30, 2024 | Market Trends

In the heart of Louisville, real estate embodies a simple truth: everyone can indeed win. As an appraiser and an optimist who always looks for the silver lining, I see the essence of ‘Win-Win’ deeply ingrained in the process of buying and selling properties.

Just think of the definition of market value—a probable price struck when buyers and sellers, each acting in their own best interest without pressure, reach a harmonious agreement. This is the epitome of ‘Win-Win’ in our world.

But let’s get practical—how does this philosophy translate into the nuts and bolts of property valuation and deciding how to list your home?

It all begins with facts. A quote that I love is as follows: True victory is not in the acquisition alone but in the integrity of the transaction. Misrepresentation benefits no one.

That’s why due diligence is a cornerstone. And for us real estate professionals, our role is crucial—we must anchor our valuations in reality, not fancy. In this context, thinking ‘Win-Win’ is built on understanding the facts of our current real estate landscape in Louisville.

Let’s lay out these facts, not with complexity but with the clarity that empowers. With a clear view of how the market has fared in the first month of 2024, we pave the way for decisions that benefit all.

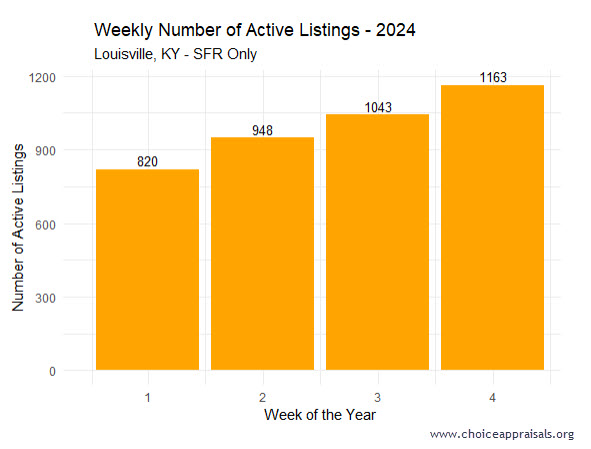

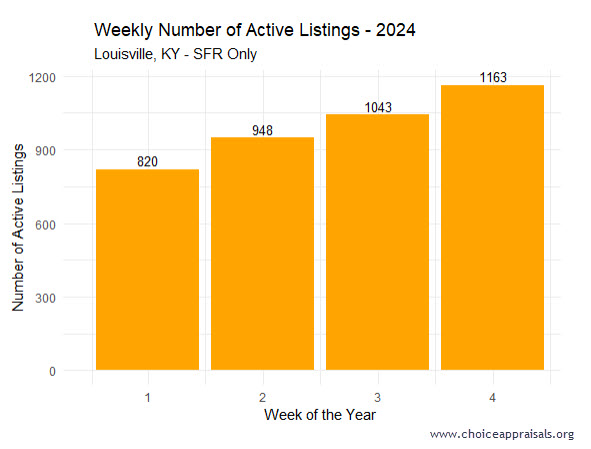

Active Listings: Climbing Towards More Opportunities

The bar graph illustrates an upward trend in the number of active listings from 820 in the first week to 1163 by the fourth week.

A growing inventory could be indicative of two trends: either sellers are entering the market to take advantage of favorable conditions, or it could suggest a slowdown where listings are staying on the market longer than in previous periods.

It’s important for agents and homeowners to watch this trend closely, as a high inventory level could lead to a more competitive market for sellers, possibly affecting prices and selling strategies.

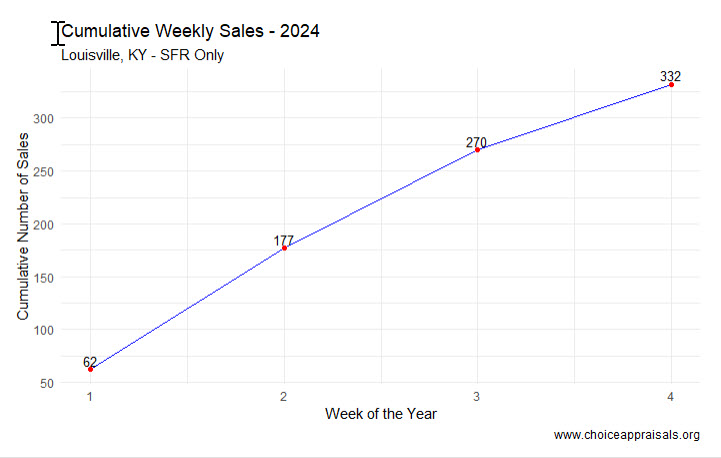

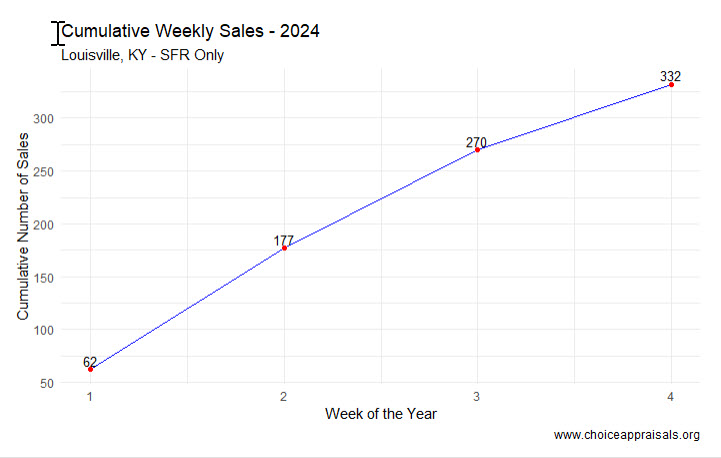

Cumulative Sales: Assessing the Market’s Lift-Off

The “Cumulative Weekly Sales – 2024” graph for Louisville, KY, depicts an upward trend in property sales over the first month, with sales rising from 62 to 332. While at first glance this seems to indicate a thriving market, we have to be careful.

The trend does not necessarily signify robust growth without a benchmark. Seasonal influences also play a crucial role in real estate activity. So, it’s important to question whether this early-year sales uptick means.

Time will tell but for the sake of home buyers, realtors and appraisers, we hope it’s a sign of greater sales volume than last year.

In this context, a Win-Win scenario materializes when everyone leverages this data coupled with the information about active listings to make decisions that reflect both the present moment and the potential of the market’s future.

MLS Areas: Decoding the Sales Price Variance

The graph showcasing the “Median Sold Price by Area – 2024” in Louisville, KY, for single-family residences reveals varied median prices across nine different areas.

This variance highlights the diverse nature of the housing market within the city, suggesting that certain areas are more in demand or possess attributes that command higher prices—factors such as school districts, proximity to amenities, and neighborhood desirability might be influencing these figures.

Notably, Area 8 stands out with a median price significantly higher than the others, which could indicate a premium neighborhood or area with larger or more luxurious homes. Conversely, Areas 1 exhibits a notably lower median sold price, which could reflect a variety of factors such as older homes, or more modest housing options.

Interesting Fact: Area 1 had the second highest amount of sales volume for the first four weeks of January 2024 with 47 sales. I personally have done more Louisville appraisals in this part of town in the past 30 days. Area 8 came in at #5 with 35 sales. It’s funny how the winner changes when we change the lens that we look through.

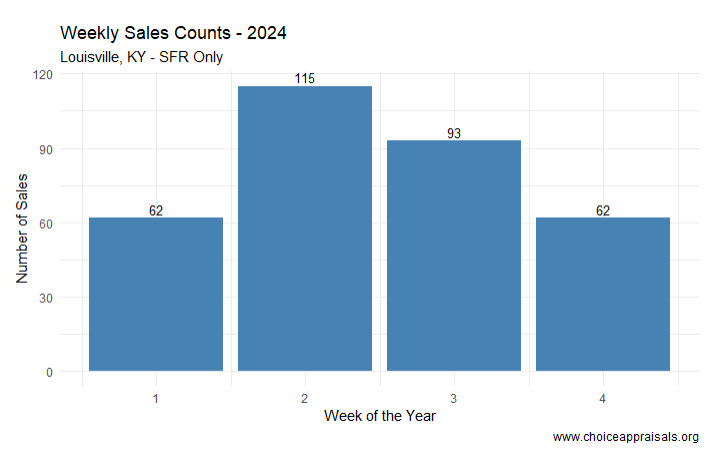

Weekly Sales: Unpacking the Market’s Pulse

The “Weekly Sales Counts – 2024” graph for Louisville, KY, presents a roller coaster like sales pattern within the first month of the year. We begin with 62 sales in week one, surge to 115 sales in the second week, then experience a decrease to 93 in week three, before returning to the starting point of 62 sales in week four.

This ebb and flow could reflect a number of underlying market dynamics. The initial rise in sales might indicate a wave of activity often seen at the beginning of a new year, as buyers and sellers enter the market with fresh goals.

Then, week three seems to whisper, “Let’s just slow down and think about this,” possibly due to buyer hesitancy or sellers holding out for better offers. By week four, we’re back to where we started, which could be a sign of market stabilization—or maybe it’s just taking a nap after the excitement of the year end – I think/hope it’s the latter!

The subsequent fall could suggest that this initial enthusiasm is tempered by external factors, such as economic news or interest rate adjustments, which may cause market participants to act more cautiously.

Overall, this data underscores the importance of monitoring weekly market movements closely, as they can provide early indications of shifts in buyer and seller behavior that could impact strategy and decision-making.

Valuations: Crafting a Win-Win Strategy

When it comes to valuations, ‘Think Win-Win’ is about fairness and balance. For realtors and clients in Louisville, here’s how you can put this into practice:

Stay Informed and Educate: The real estate market is dynamic, and being well-informed is key. An educated homeowner is more likely to price their home accurately, and an educated buyer can make a fair offer.

Regular Market Analysis: Keep an eye on how homes are priced in different areas. Realtors should provide homeowners with a regular analysis of how the market is moving, not just in terms of price but also in how long homes stay on the market.

Set Realistic Expectations: Help clients set realistic expectations based on market data. If the market is indicating a decrease in demand, homeowners should be prepared for potentially longer selling times.

Listen and Adapt: A Win-Win situation comes from understanding what the other party values. Listen to buyers and sellers carefully and adapt your strategy to align with their goals.

Prepare for Different Scenarios: The market can shift unexpectedly. Have a plan for different scenarios, whether it’s a sudden uptick in interest rates or a change in buyer sentiment.

Conclusion

In the Louisville market, adopting a ‘Think Win-Win’ approach in real estate isn’t just idealistic, it’s practical. It’s about creating transactions where buyers and sellers walk away satisfied, where the value is fair, and where the community thrives on the integrity of its dealings.

I invite you to reflect on this philosophy and how it has shaped your experiences in real estate. Have you encountered situations where the Win-Win approach turned a negotiation around or created a surprising opportunity? Share your stories and insights. Let’s continue the conversation and learn from each other, so we can all reap the rewards of a market that works for everyone.

by Conrad Meertins | Jan 21, 2024 | Valuation

Are you striving to master the art of perfecting listing prices in today’s dynamic real estate market?

Understanding the home appraisal process in Louisville, KY is a crucial step in this journey. Imagine being the realtor or homeowner who always knows the property’s true worth, navigating the valuation landscape with ease.

It’s not just about the numbers; it’s about interpreting them in the context of a constantly evolving market.

This blog delves into the subtleties of real estate valuation, examining the critical aspects that influence it, from an appraiser’s local market knowledge to the unique features of properties, and adapting to rapid market changes.

By aligning these insights with Stephen Covey’s “First Things First” principle, my goal is to help you to navigate these complexities effectively, ensuring more informed decision-making and successful client outcomes.

Common Valuation Challenges

A critical aspect often encountered in real estate transactions in Louisville, and in most areas, is the difference between the appraised value and market value of properties.

This difference, even as appraisers strive to provide the current market value, can largely be attributed to the appraiser’s expertise and understanding of the local market.

Appraiser’s Expertise and Local Market Knowledge

Appraisers strive to estimate a property’s value based on a set of standardized criteria, including the analysis of comparable sales, property condition, and market trends.

However, the depth of an appraiser’s local market knowledge can significantly influence the accuracy of the appraisal. A home appraiser with extensive experience and familiarity with a specific area of Louisville is more likely to provide a valuation that closely reflects the current market conditions.

They can better understand and interpret nuances like local demand trends, and even subtle influences like school districts or future development plans.

In contrast, an appraiser who may not be as deeply versed in the specifics of a locale might miss these subtleties. This gap in local insight can lead to variances between the appraised value and the market value as perceived by buyers and sellers in that specific market.

Navigating the Valuation Landscape

For realtors, understanding this aspect is crucial. Recognizing the importance of an appraiser’s local expertise can help in setting realistic expectations for both buyers and sellers.

It also underscores the value of engaging appraisers who are well acquainted with the property’s area, ensuring a more accurate reflection of the current market value.

Encourage your sellers to ask questions that will indicate that the appraiser knows the area. What if his answers sound fishy? Request another appraiser from the bank.

In line with Stephen Covey’s “First Things First” principle, prioritizing this understanding can greatly aid in navigating the valuation landscape, allowing for more informed decision-making and effective client guidance in real estate transactions.

Recognizing and Communicating Unique Property Features

In the context of home appraisals, understanding how unique property features are evaluated is another crucial part of the valuation puzzle. This knowledge is especially significant when bridging the gap between an appraiser’s valuation and a buyer’s perception of value.

How Appraisers View Unique Property Features

Appraisers approach property evaluation methodically, assessing a spectrum of features from basic structural elements to unique attributes.

These unique features might include custom interior designs, recent renovations, or exceptional architectural styles. Each of these is scrutinized for its impact on the property’s overall value.

However, the value that appraisers assign to these features might not always align with a potential buyer’s perceived value.

A feature that significantly enhances the aesthetic or functional appeal of a property, like a professionally landscaped garden, may be highly attractive to certain buyers.

Yet, in terms of appraised value, this feature might not lead to a proportional increase. This discrepancy arises because while appraisers acknowledge these features, their assessment is grounded in quantifiable impact more than subjective appeal.

The Realtor’s Role in Highlighting Unique Features

For realtors, this underscores the importance of effectively recognizing and communicating these features during transactions. Understanding the appraiser’s perspective on unique property features allows realtors to better manage client expectations regarding valuation.

Moreover, it empowers realtors to highlight these features in ways that resonate with potential buyers, showcasing the added value these unique aspects bring to the property.

By aligning appraisal insights with strategic communication, realtors can navigate the valuation landscape more effectively, ensuring a smoother transaction process and potentially enhancing property appeal in the competitive real estate market.

Adapting to Market Changes and Informing Appraisers

Understanding the appraisal of unique property features is just one facet; equally important is adapting to and proactively addressing rapid market changes. These fluctuations can significantly influence property valuations, and understanding how to communicate these shifts to appraisers is critical.

The Impact of Rapid Market Changes on Valuations

The real estate market in Louisville, KY and across the country is inherently dynamic, often influenced by factors like economic shifts, interest rates, and local developments.

These changes can swiftly alter property values, sometimes quicker than can be reflected in an appraisal based on historical data. For instance, a sudden surge in demand in a particular area might significantly increase property values, a change that recent sales data may not fully capture.

Proactive Communication with Appraisers

In these scenarios, the role of a realtor extends beyond just understanding market dynamics. It involves actively communicating these shifts to appraisers early in the valuation process.

While appraisers are experts in their field, they might not always be immediately aware of very recent market changes. By providing appraisers with the latest market insights, realtors can ensure that these factors are considered in the home appraisal analysis.

This proactive approach aligns with Stephen Covey’s “First Things First” strategy. Prioritizing the sharing of up-to-date market information with appraisers helps ensure that the valuation accurately reflects current market conditions.

This not only aids in creating more accurate appraisals but also helps in setting realistic expectations for both buyers and sellers.

Staying Informed and Adaptable

For realtors, staying informed about the latest market trends and developments is imperative. This means regularly reviewing market reports, engaging with local real estate networks, and maintaining a pulse on any sudden changes.

By being well-informed and adaptable, realtors can effectively guide their clients through the complexities of real estate transactions in a rapidly changing market.

Mastering the Art of Real Estate Valuation

The journey through the landscape of real estate valuation is both challenging and rewarding.

Understanding the depth of an appraiser’s local market knowledge, recognizing the impact of unique property features, and staying agile in the face of market dynamics are not just tasks – they are essential skills for today’s realtors.

By proactively communicating with appraisers, aligning with the latest market trends, and effectively highlighting the unique aspects of properties, realtors can significantly enhance their service to clients.

This approach, rooted in the wisdom of “First Things First,” is not just about adapting strategies; it’s about foreseeing opportunities and navigating the real estate market with confidence and expertise.

As we embrace these principles, we not only succeed in individual transactions but also contribute to the broader narrative of real estate professionalism and homeowner satisfaction.

by Conrad Meertins | Jan 15, 2024 | Market Trends

Imagine uncovering a secret blueprint that could transform your approach to real estate. This blueprint merges Stephen Covey’s timeless wisdom from “Seven Habits of Highly Effective People” with the dynamic realm of real estate transactions. The focus here is on the second habit, “Begin with the End in Mind,” a principle I believe is key to navigating the ever-evolving real estate market.

In the following sections, we’ll explore recent Louisville, KY real estate trends and uncover often-overlooked insights.

As we do, we can apply the ‘Begin With the End in Mind’ approach to our 2024 Real Estate Strategy. This isn’t just about goal setting—it’s about using market analytics to guide our decisions in real estate.

Let’s dive into how this forward-thinking principle can sharpen our competitive edge.

Q1 Insights: Setting the Stage for Annual Market Trends

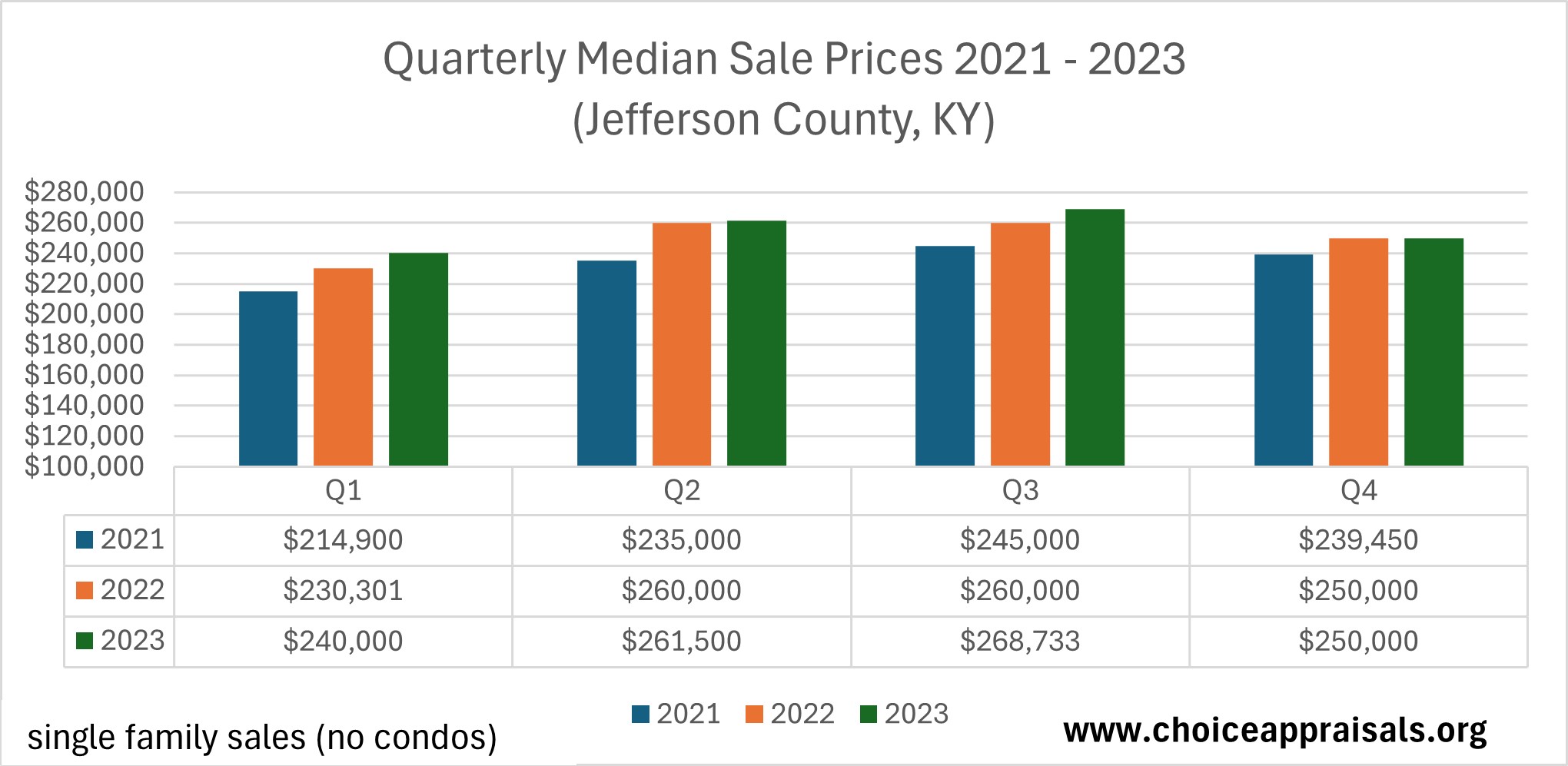

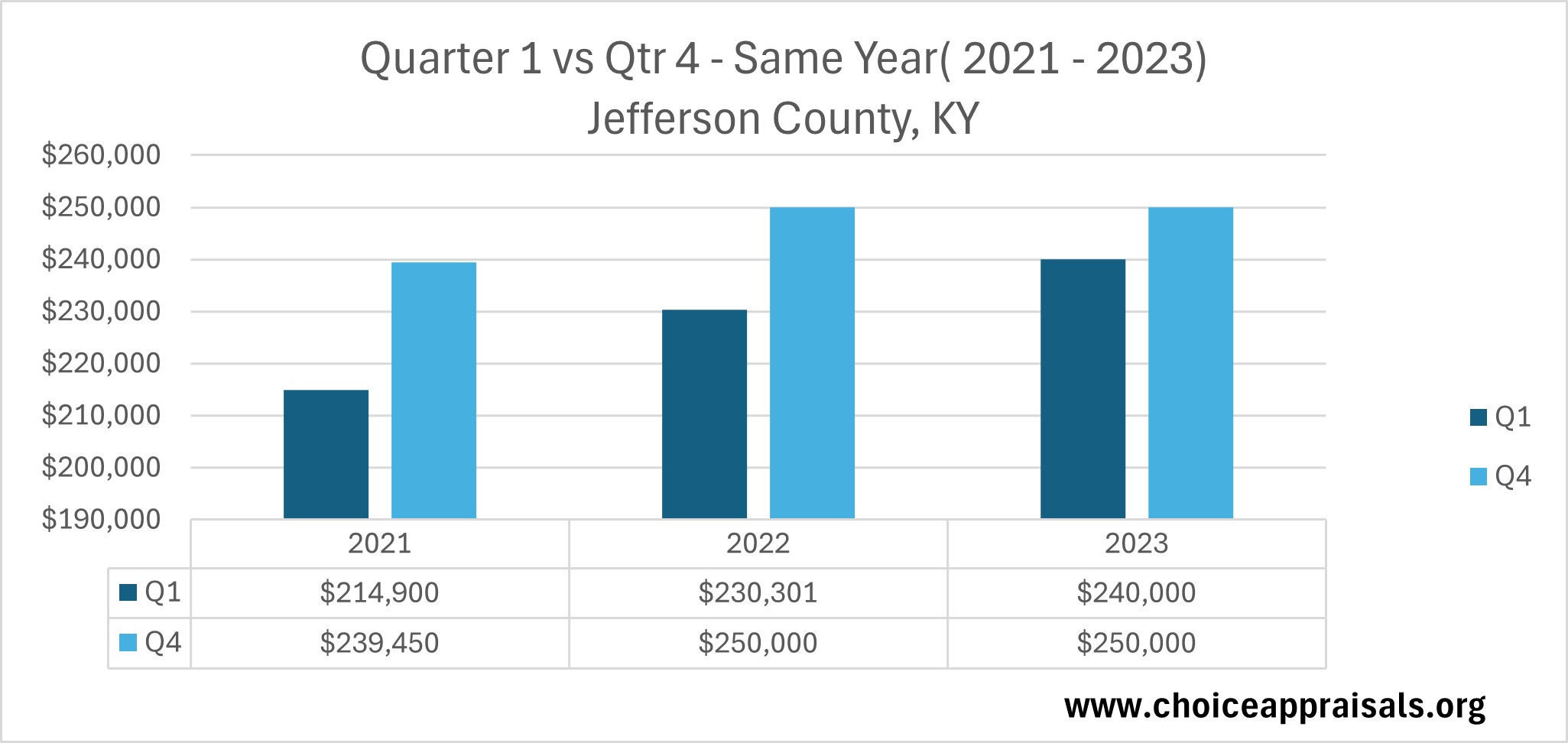

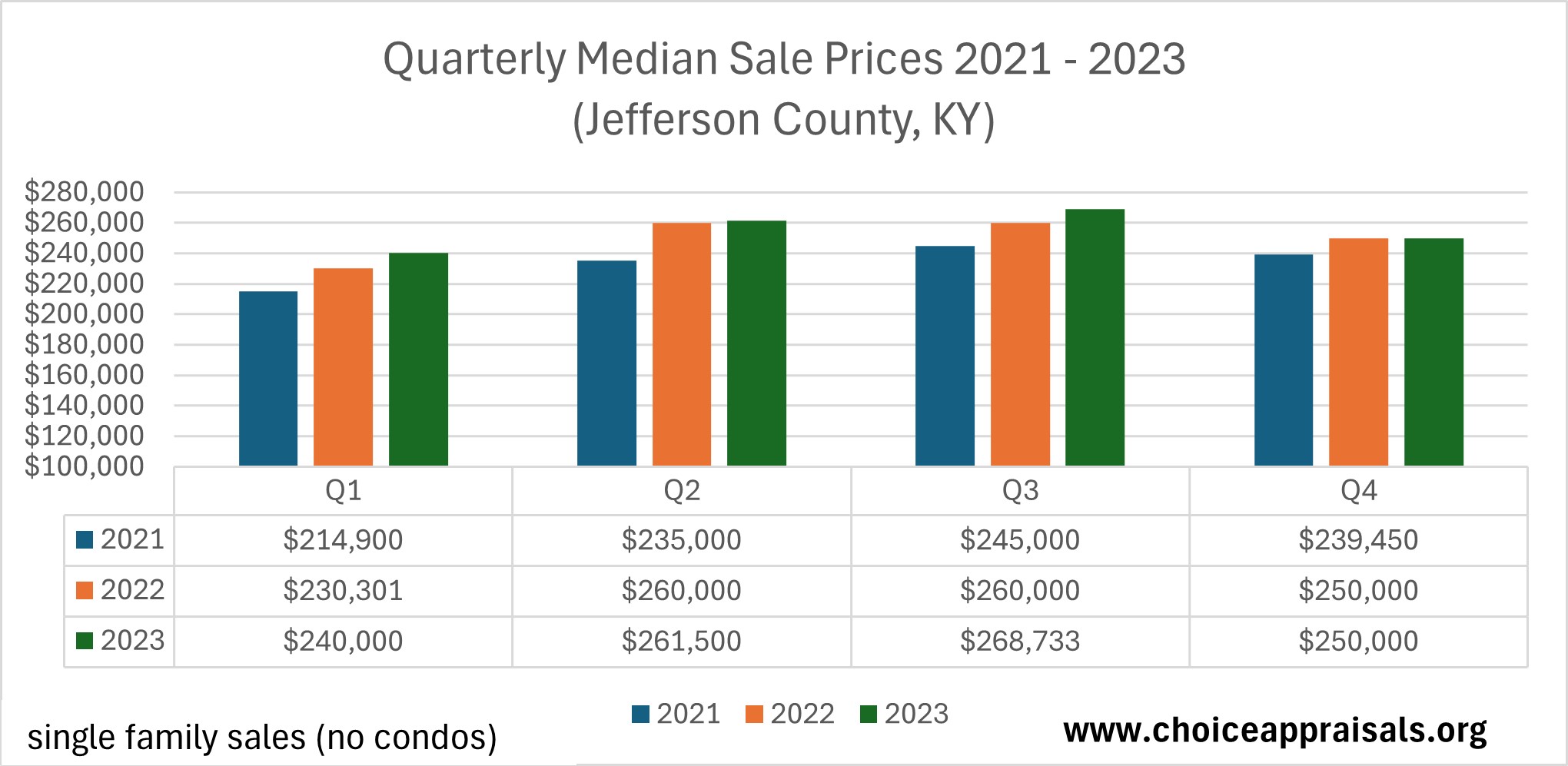

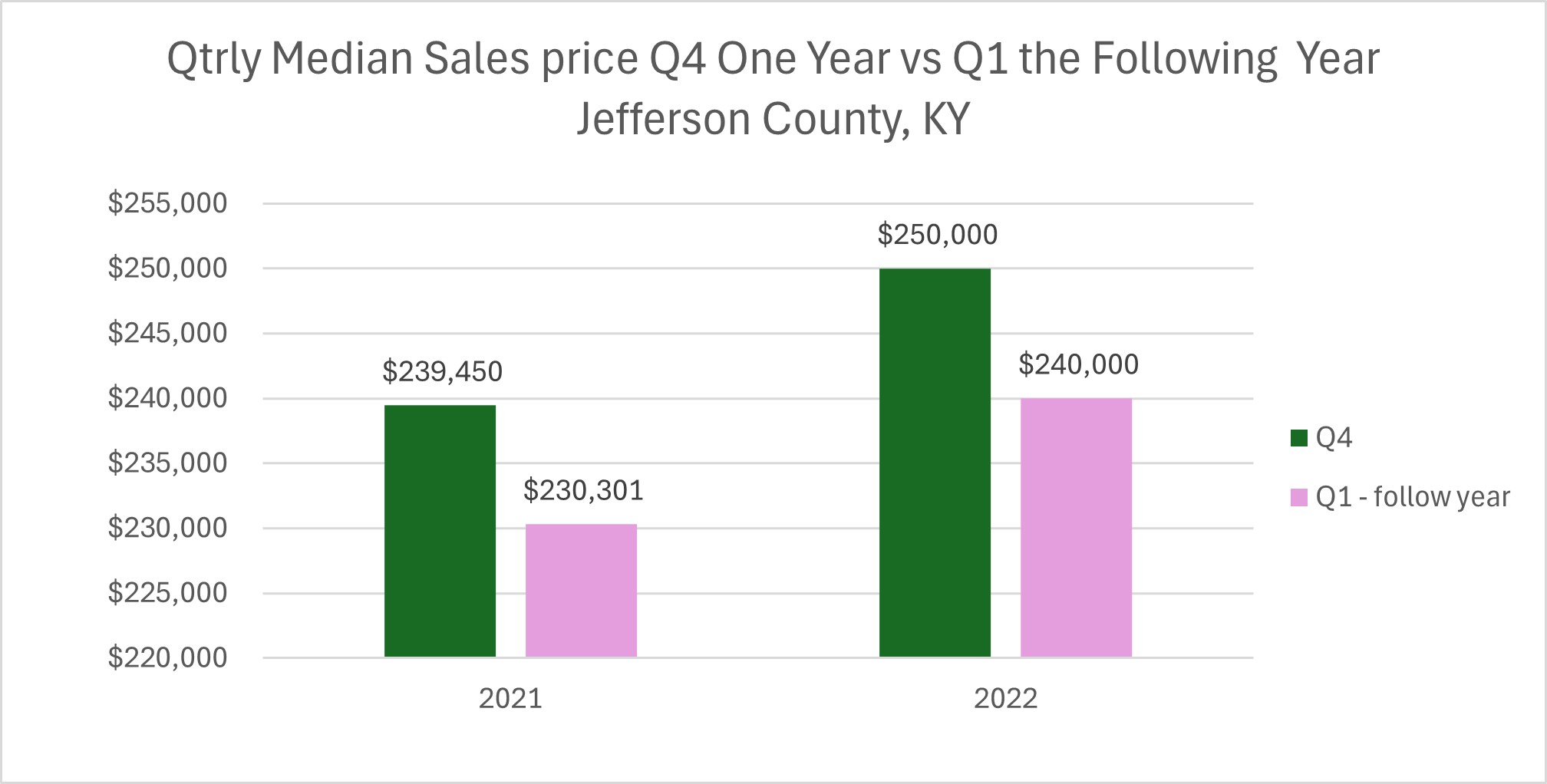

Let’s examine the market trends reflected in the quarterly median sale prices from 2021 to 2023 in Louisville, KY. Despite a reduction in the number of homes sold, which isn’t shown on this graph, there’s a clear upward trend in the prices that buyers have been willing to pay.

Starting each year with a glance at Q1, we can observe that 2023 opened with home prices that were higher than at the beginning of 2022, which also had surpassed 2021’s figures. This consistent rise in initial prices year over year is a positive indicator of growing market strength.

However, looking at the year’s end, we notice a slight deviation from this trend. While the closing prices of 2022 improved upon 2021, the same cannot be said for the transition from 2022 to 2023.

Although the prices didn’t climb higher at the end of 2023, they didn’t fall either, maintaining the gains from earlier in the year. This stability, rather than a decline, suggests that the market is holding its value well, which is reassuring for both current and prospective homeowners.

The Closing Quarter: Reflecting on Market Resilience

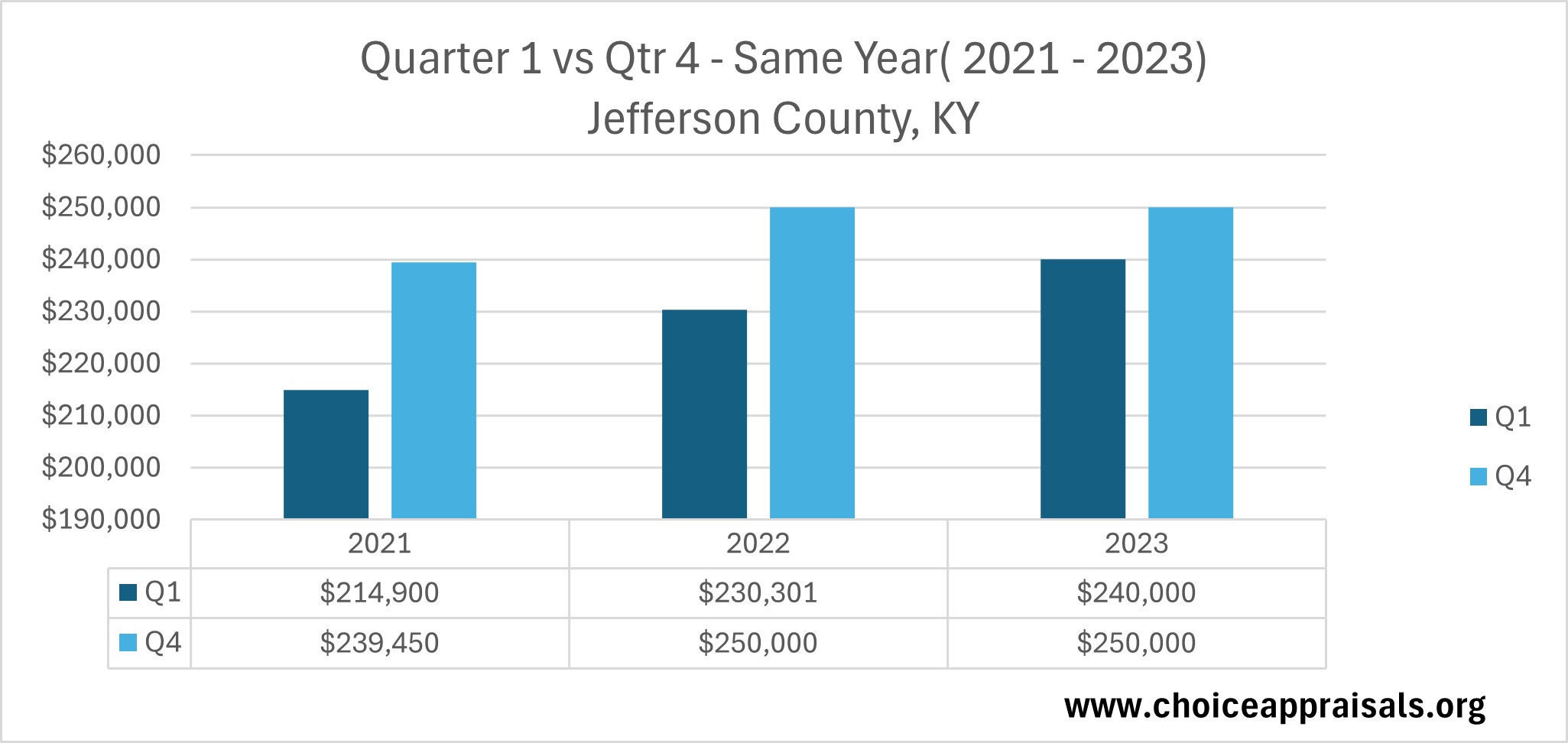

Consistency is key in the real estate market, and the trends in Jefferson County, KY, reaffirm this saying. If we take a closer look at how property prices have behaved at the start and end of each year from 2021 to 2023, we find an encouraging pattern.

Despite the expected seasonal dip towards the end of the year, the big picture is one of growth. Specifically, the comparison between Q1 and Q4 within the same year shows us that regardless of the short-term fluctuations, the overall value of homes has been on an upward trajectory.

For instance, in Louisville, KY as a whole, the opening quarter’s median sale prices have consistently been lower than those at the year’s close. This tells us that homeowners who hold onto their properties throughout the year could see a natural increase in their homes’ market value.

It’s a reassuring sign for long-term investors and a helpful metric for potential sellers planning the right time to enter the market. This trend highlights the resilience of the local real estate market.

It also demonstrates that even with the anticipated year-end slowdown, property values in Louisville, have maintained a positive momentum.

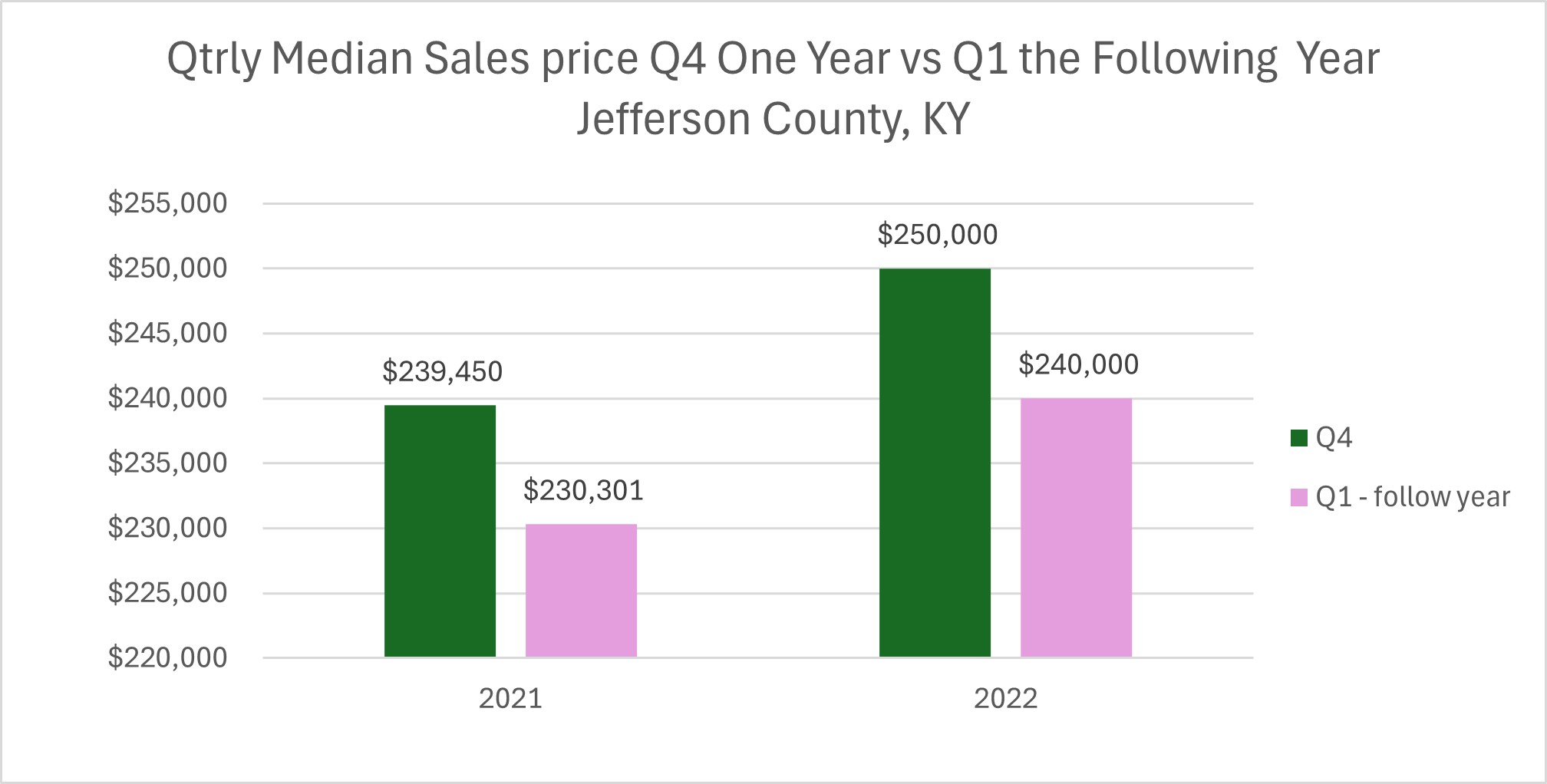

New Year’s Market Outlook: Beyond the Initial Dip

As we turn the calendar page each year, we see a recurring theme in the housing market. The beginning of the year often starts with a modest reset in home prices from their previous year-end highs.

This dip, however, is just a small chapter in an overall success story, as the trend line since 2021 is pointing upwards. This pattern means that while home values might momentarily soften as the New Year chimes in, they generally pick up steam as the months roll by, pushing the market value higher as the year progresses.

This trend is crucial for both buyers and sellers to keep in mind. If you’re considering selling your home and you’ve recently seen a property similar to yours sell at a peak price, it’s important to temper expectations.

A home appraisal report may well contain a valuation adjustment in line with the current market phase, particularly if there’s been a recent cooling. It’s a reminder to always be attuned to the rhythm of the market and to set your strategies accordingly.

Why Pay Attention to These Trends?

In the spirit of Stephen Covey’s second habit, “Begin with the End in Mind,” we turned our focus to the critical importance of market trends in the real estate landscape.

It’s not just a matter of peering through the data; it’s about understanding the narrative behind the numbers. This is where the essence of strategic foresight in real estate comes to life.

Paying close attention to the highs and lows of the market allows us to navigate with precision and purpose, ensuring that each step taken is a deliberate stride towards our ultimate objectives.

Maximizing Returns:

Just as a captain charts a course by the stars, real estate market trends serve as our celestial guides, helping us navigate towards maximum profitability.

Just as a captain charts a course by the stars, real estate market trends serve as our celestial guides, helping us navigate towards maximum profitability.

Recognizing the right time to list or purchase can make all the difference in the financial outcome of a real estate transaction. In Louisville, KY, for example, the upward trend in home prices, even amidst seasonal fluctuations, indicates a potential for sellers to maximize returns by timing the market judiciously.

Identifying Growth Opportunities:

By observing the shifts and preferences in the housing market, we identify not just current demands but forecast emerging trends that signal growth opportunities.

Understanding Market Shifts:

The real estate market is as dynamic as the seasons, changing in response to a multitude of economic and societal factors.

The real estate market is as dynamic as the seasons, changing in response to a multitude of economic and societal factors.

Having a keen eye on these changes allows us to predict and prepare for the natural cycles of the market. It’s about reading the signs and knowing when to act. This understanding empowers us to make informed decisions that resonate with confidence and clarity, much like the principles Covey advocates.

Conclusion

In conclusion, the philosophy of ‘Begin with the End in Mind’ encourages us to thoughtfully consider how our current actions will shape our future outcomes. It’s not merely about staying informed but about being strategically equipped to make decisions that align with our ultimate aspirations.

Whether we’re buying, selling, providing guidance, or appraising, the insights we glean from a diligent analysis of market trends are priceless. They lay down a framework for informed action, grounded in deep understanding, which empowers us to navigate the real estate landscape with both foresight and the flexibility to adapt to ever-changing conditions.

By Conrad Meertins Jr

by Conrad Meertins | Jan 8, 2024 | Market Trends

The Power of Proactivity in Real Estate

Have you ever watched a chess master at work? Each move is made not just for the present but for the unfolding game. If she is going to win, one key will be mastering the habit of proactivity.

It’s little wonder that this habit is the first one mentioned of Stephen Covey’s Seven Habits of Highly Effective People. Will Real Estate professionals need this quality for 2024? Absolutely.

As Covey mentioned, exemplifying this habit means that we give ourselves space between stimulus and response and claim our control. In this article I’ll be reviewing activity from the first week of January with the goal of helping you to be proactive in the real estate game.

Current Market Pulse: A Snapshot of Early January 1/1/24 – 1/7/24

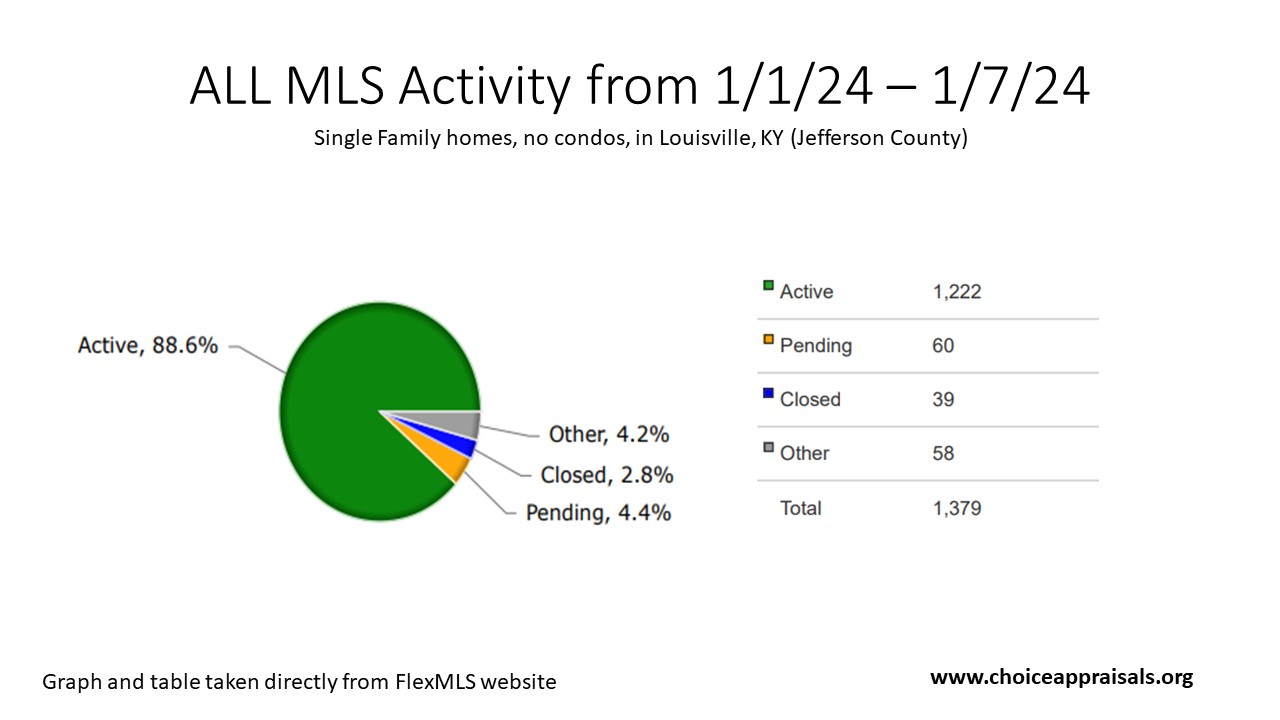

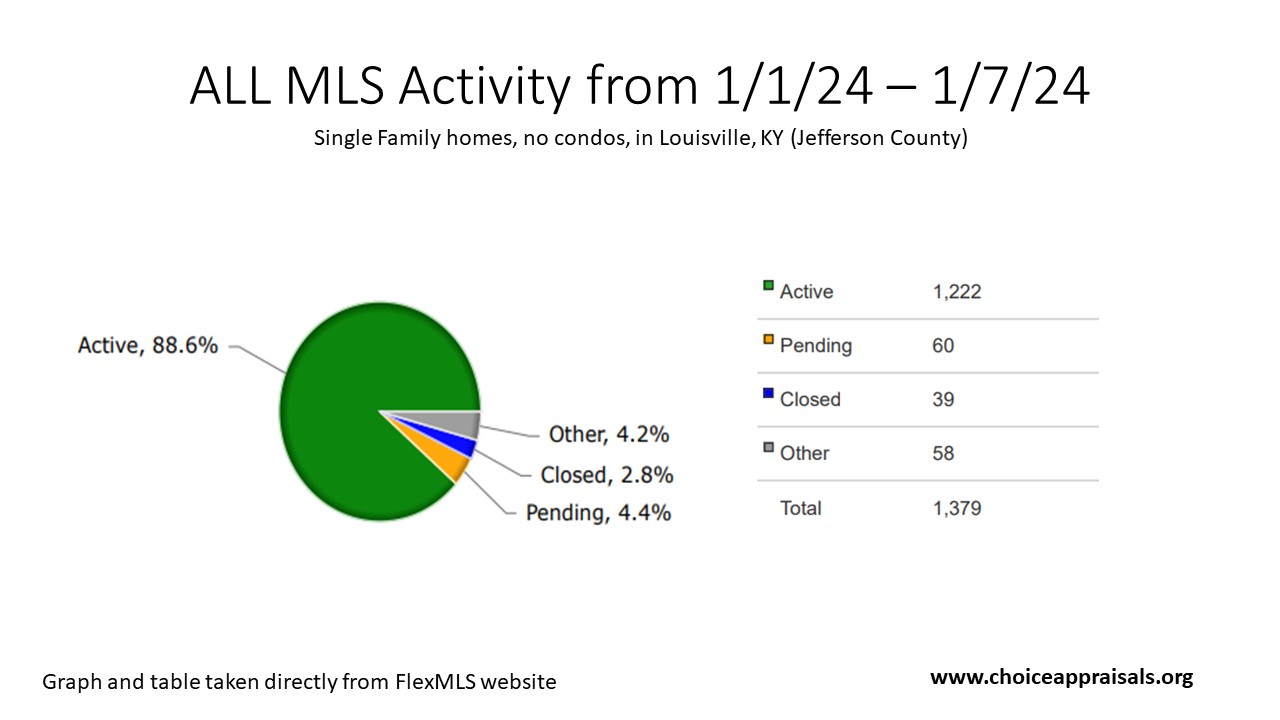

Is Our Market Bursting with Options?

As we stepped into January, we saw 1,222 homes for sale here in Louisville, KY. This could mean lots of choices for buyers. But proactive real estate professionals know there’s a need to look a bit closer.

Only a small slice of homes are actually getting offers (4.4%) and even fewer are being sold (2.8%). Could some homes be priced too high? Or is something else making buyers hesitate?

Something we can’t get away from is the fact that interest rates are between 6.62% and 7.20% for most home loans (depending on where you shop). Even though these rates have dipped a tiny bit, they’re still pretty high compared to the past, which could make buyers slow down and think twice as they contemplate that higher monthly payment.

Plus, let’s be real, moving when it’s cold and right after spending time off with family isn’t a fun idea for many people. That can definitely make for a slower market.

So what’s the real deal in Louisville, with our market (1222 active listings) in this chilly season?

We might have:

- a vibrant market with lots of options for buyers.

- a market that’s taking a breather with homes not selling as fast as expected. Or

- overpriced listings.

To really understand what’s happening, we’re going to take a closer look at the homes that did sell during the first seven days of January 2024 and check out the Cumulative Days on Market of homes that are still active.

What Week 1 -January 2024 Sales Reveal

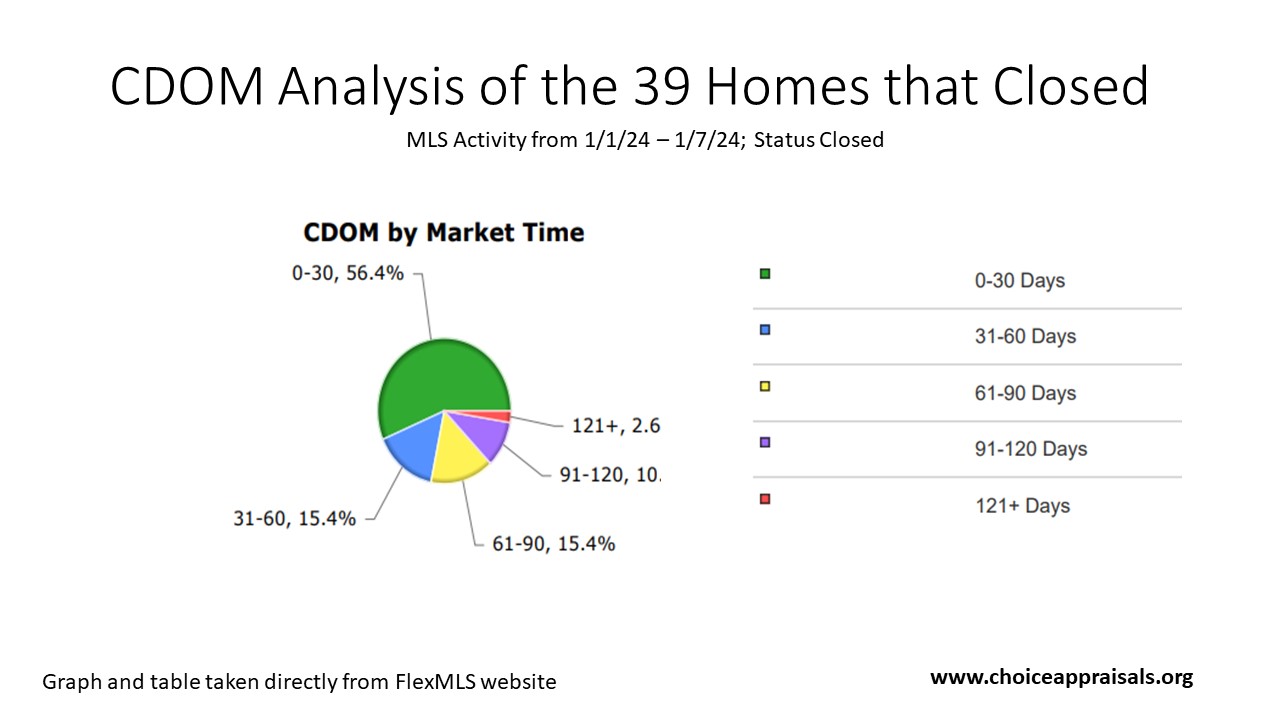

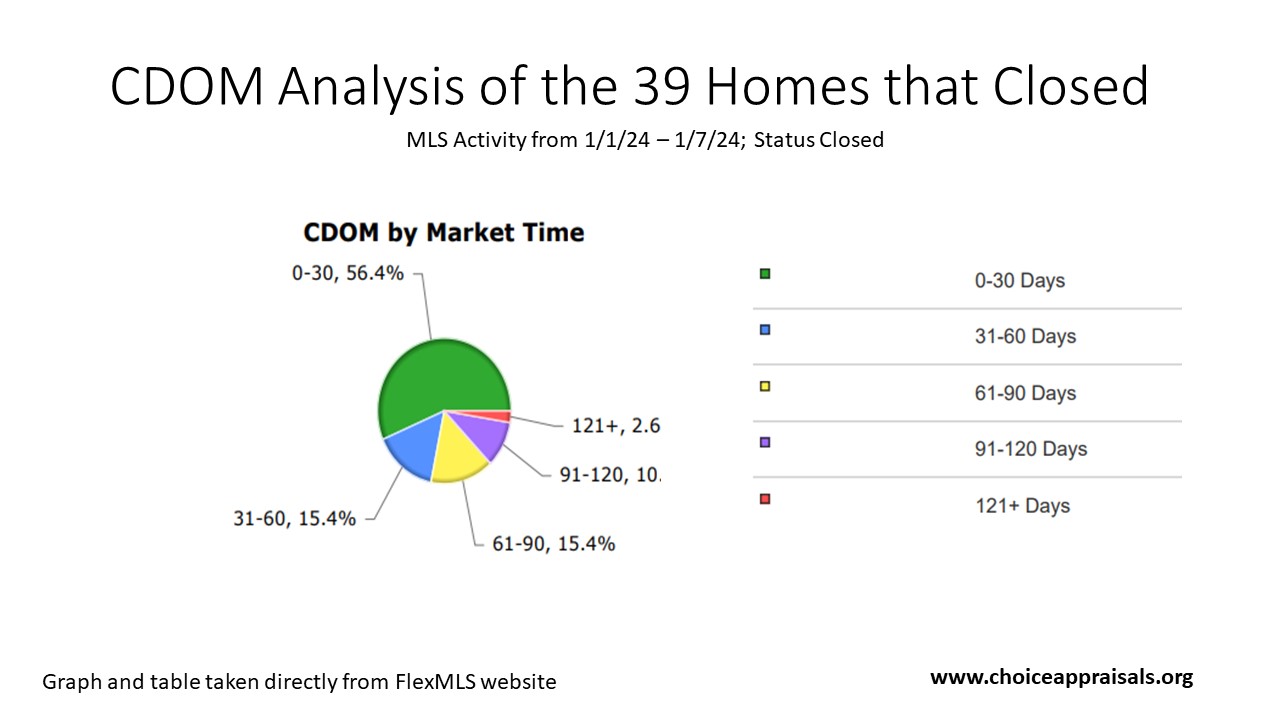

Peering into the recent sales gives us a clearer picture of our winter market. In January’s first week, out of 1,222 homes up for grabs, 39 made it across the finish line. But how fast?

The pie chart lays it out: Over half of the homes sold (56.4%) in 30 days or less. This brisk movement indicates a segment of our market is priced just right—homes that buyers are snatching up quickly, likely because they hit that sweet spot of value and appeal.

Then there’s the 15.4% that closed in 31-60 days and another 15.4% in 61-90 days.

These homes took their time, but not too much time. It suggests a balanced approach—perhaps a minor price negotiation here or a little patience there paid off.

The smaller slices—10% selling in 91-120 days and a sliver at 2.6% beyond 120 days—tell us some stories took longer to tell.

These could be homes where initial expectations needed adjusting, whether due to price, property quirks, or just finding the right buyer who sees a diamond where others didn’t.

While this data strengthens our understanding of the Louisville market timings, a deeper layer awaits our attention – the interplay between the final Sale Price and the Original List Price (SP/OLP). This ratio sheds light about the art of pricing accurately from the onset.

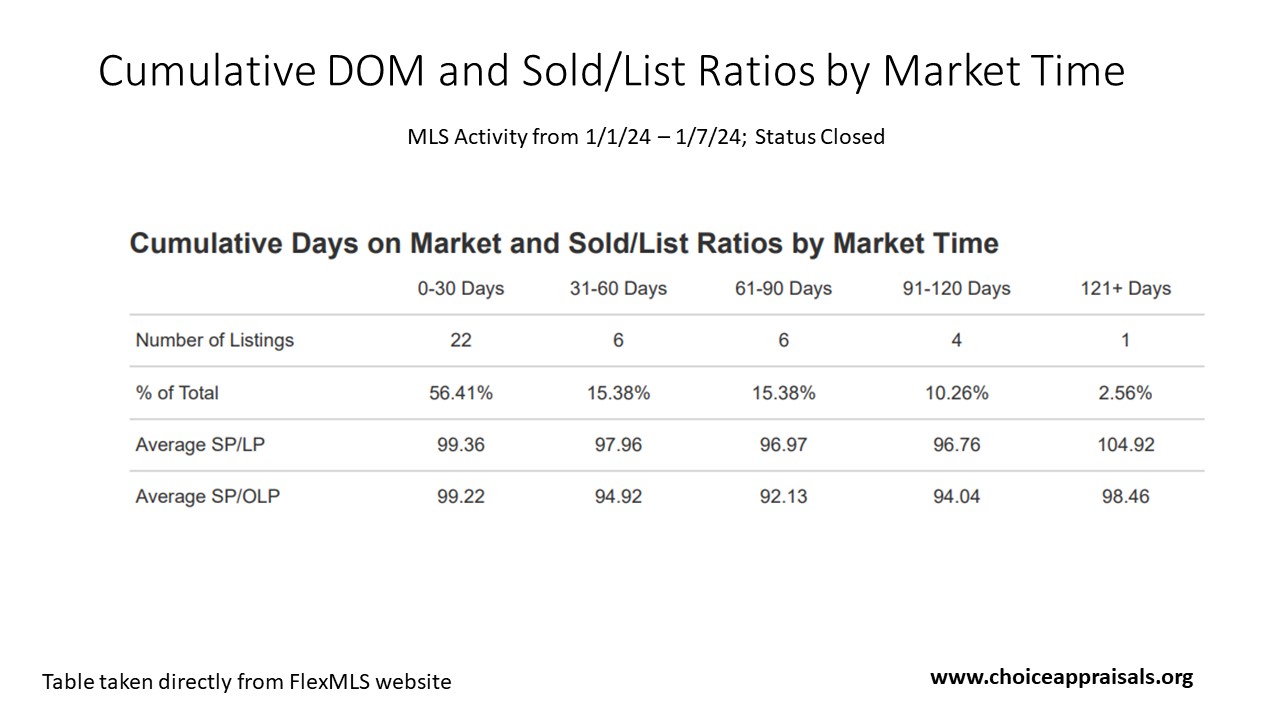

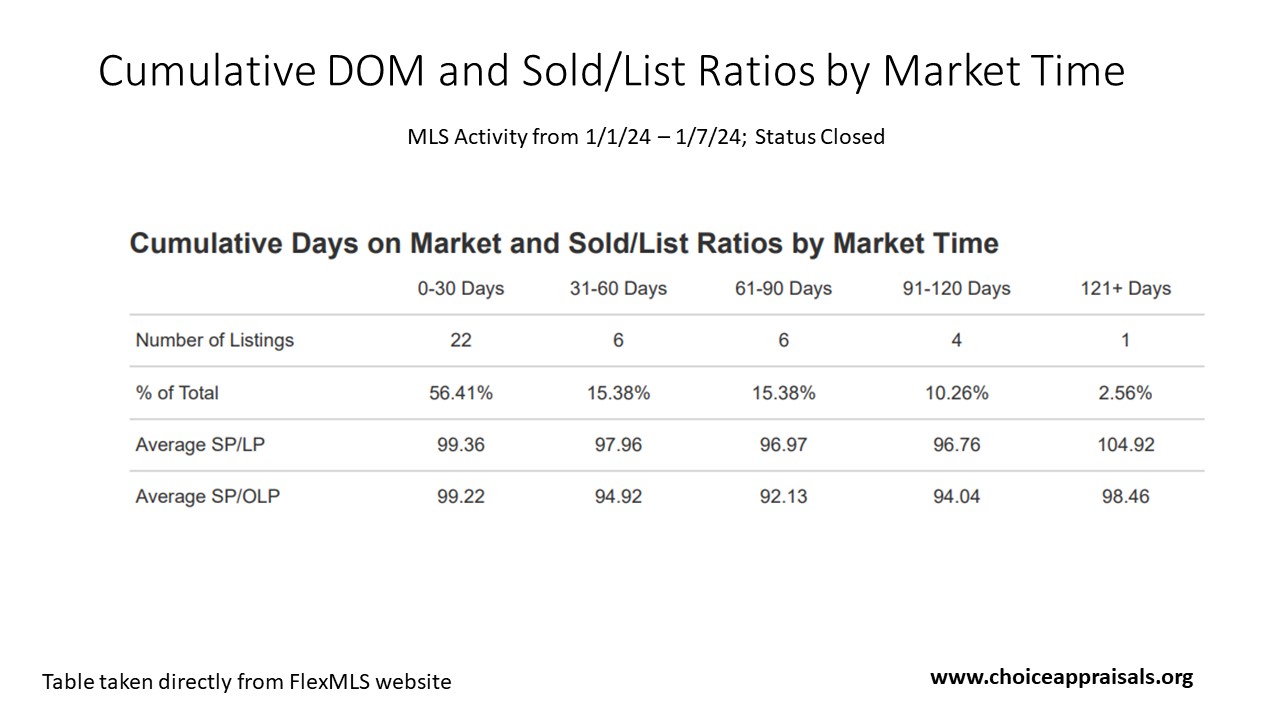

January Sales with a focus on Sold Price/List Price Ratios

The Average Sold Price to Original List Price (SP/OLP) ratio tells us how the final sale price compares to the initial asking price.

0-30 Days: Homes in Louisville, KY that sold within a month almost met their asking price, with an SP/OLP of 99.22%, indicating they were likely priced right from the start.

31-60 Days: The drop to an SP/OLP of 94.92% for homes sold in one to two months hints at negotiations, perhaps due to ambitious initial pricing.

61-90 Days: A further dip in SP/OLP to 92.13% for sales in two to three months suggests either significant price drops or shifts in market trends.

Armed with stats like these you can advise clients on pricing their homes to sell within a desired timeframe, considering market dynamics.

But what about homes that are still on the market? How long have they been sitting, and what does their waiting time tell us?

To answer that question, let’s pivot to a Cumulative DOM analysis for active listings. In doing so, we’ll uncover another layer of the market’s story.

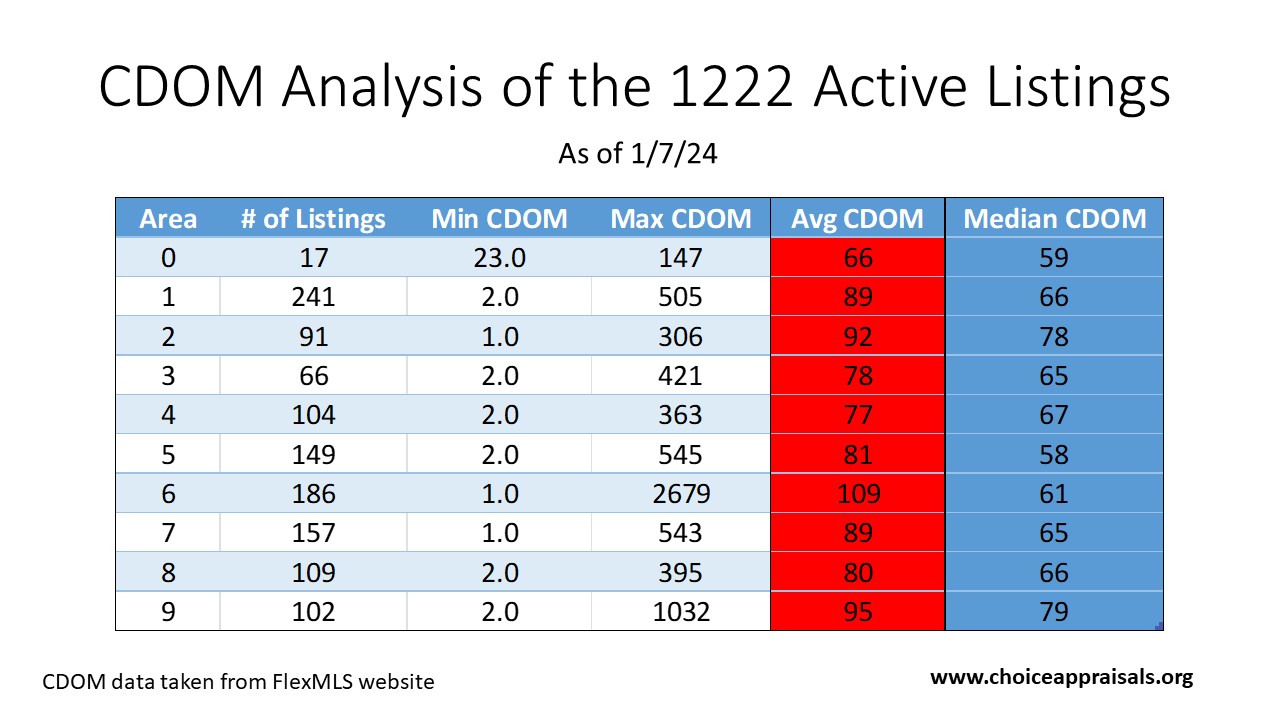

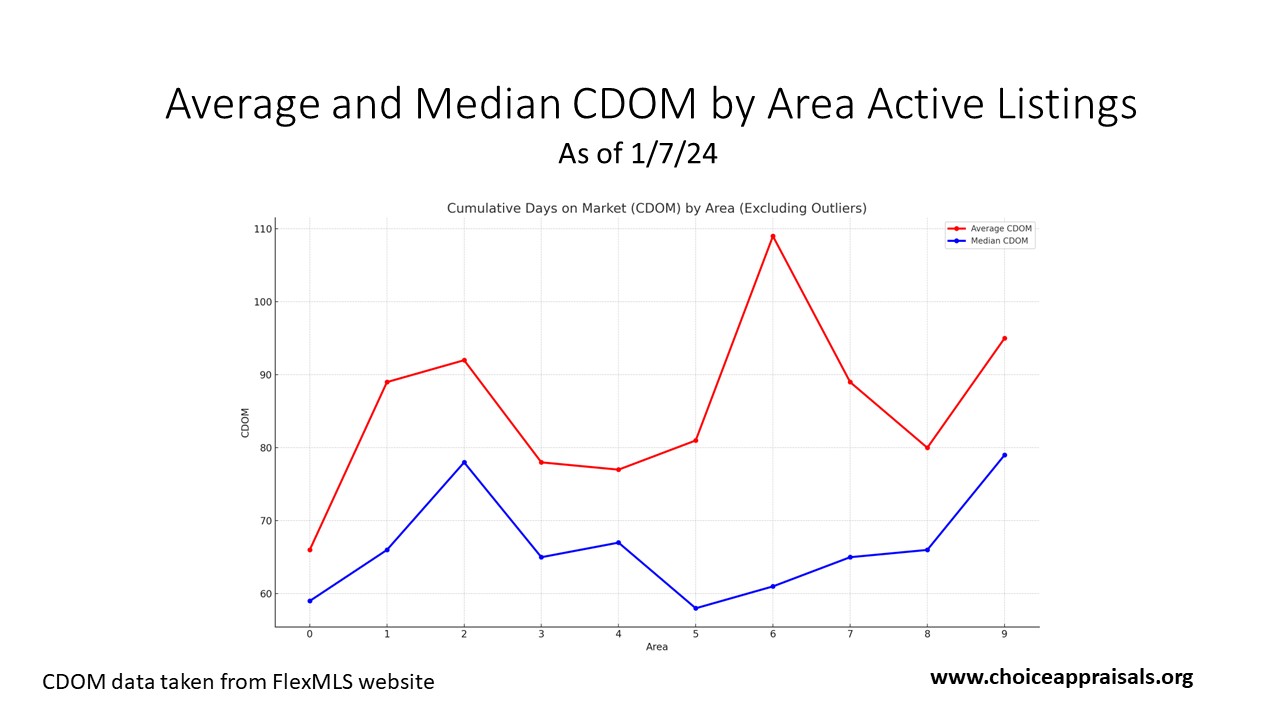

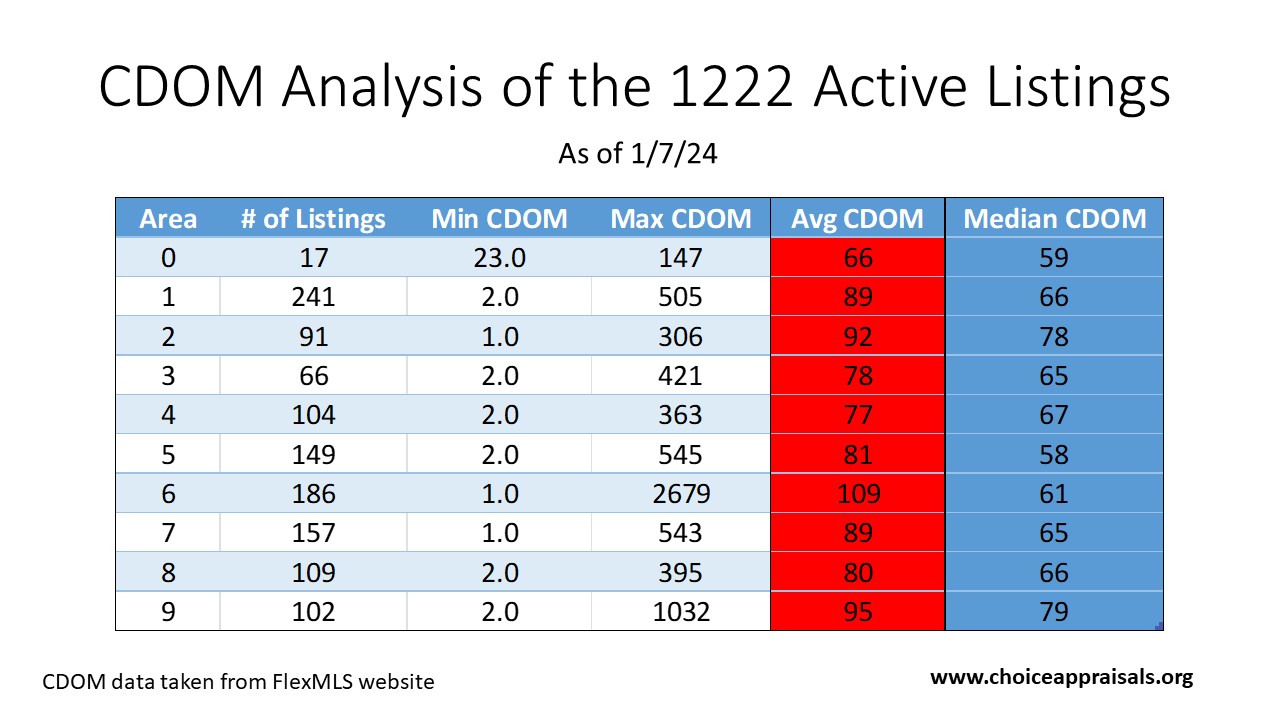

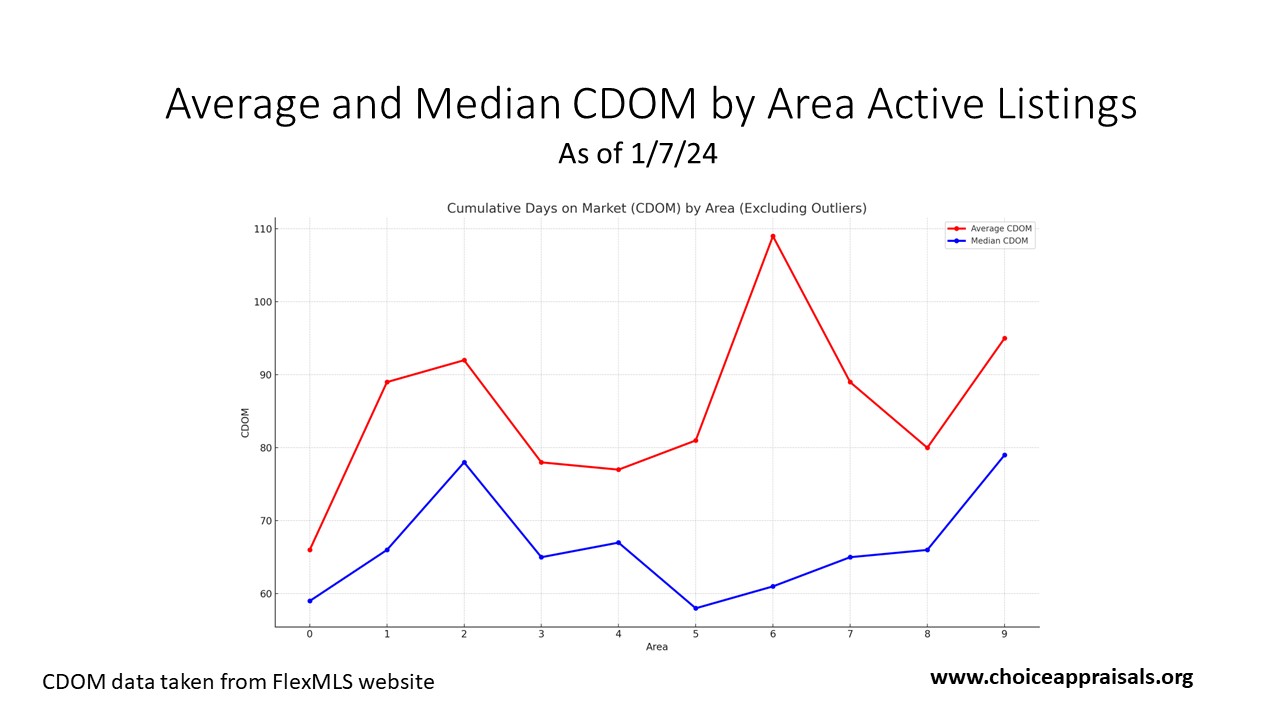

Average and Median Days on Market – for Homes that Have Not Sold

The canvas of our January market, with 1,222 active listings, is rich with detail when viewed through the lens of CDOM. The average CDOM across all MLS Areas is currently between 66 and 109 days.

The median CDOM, which ranges from 58 to 79 days across the areas, is a more balanced lens since the median is less affected by outliers. It indicates that over half of the homes have been listed for about two months or less. This is a more typical timeframe in a balanced market.

These insights are crucial for managing expectations on both ends—sellers can gauge how long it might take to sell their home, and buyers can spot opportunities for negotiating better prices on listings that have been on the market longer.

As we wrap up our review of January’s first week, remember that these statistics do more than just inform—they enable you to lead in the marketplace with authority and foresight.

But in order for that to happen you have to continue to pause after your exposure to data like this. Think about how it relates to a current or upcoming listing, and then take the appropriate response that indicates purposeful control – That’s being proactive!

Next week, we’ll delve into the second of Covey’s habits, ‘Begin with the End in Mind’, to further refine our strategic approach to real estate success.

Have a great week.

Conrad Meertins Jr.