So, you’re a real estate professional, right? You’re no stranger to appraisal reports. They’re part of your daily grind. But let’s be real, these documents can sometimes feel like they’re written in a different language. How can you crack the code to understanding them better? That’s what this article is all about.

An appraisal report, in its simplest form, is an unbiased estimate of the value of a property. It’s an essential tool for lenders, buyers, and yes, agents like you. Why? Because it provides a defensible opinion of market value of a property, which is crucial in any real estate transaction.

Understanding appraisal reports isn’t just a nice-to-have skill. It’s a must. When you know your way around these reports, you’re in a better position to advise your clients, negotiate deals, and close sales. It’s about leveling up your game in the competitive world of real estate. So, are you ready to dive in? Let’s do this.

Tip 1: Know the Basics

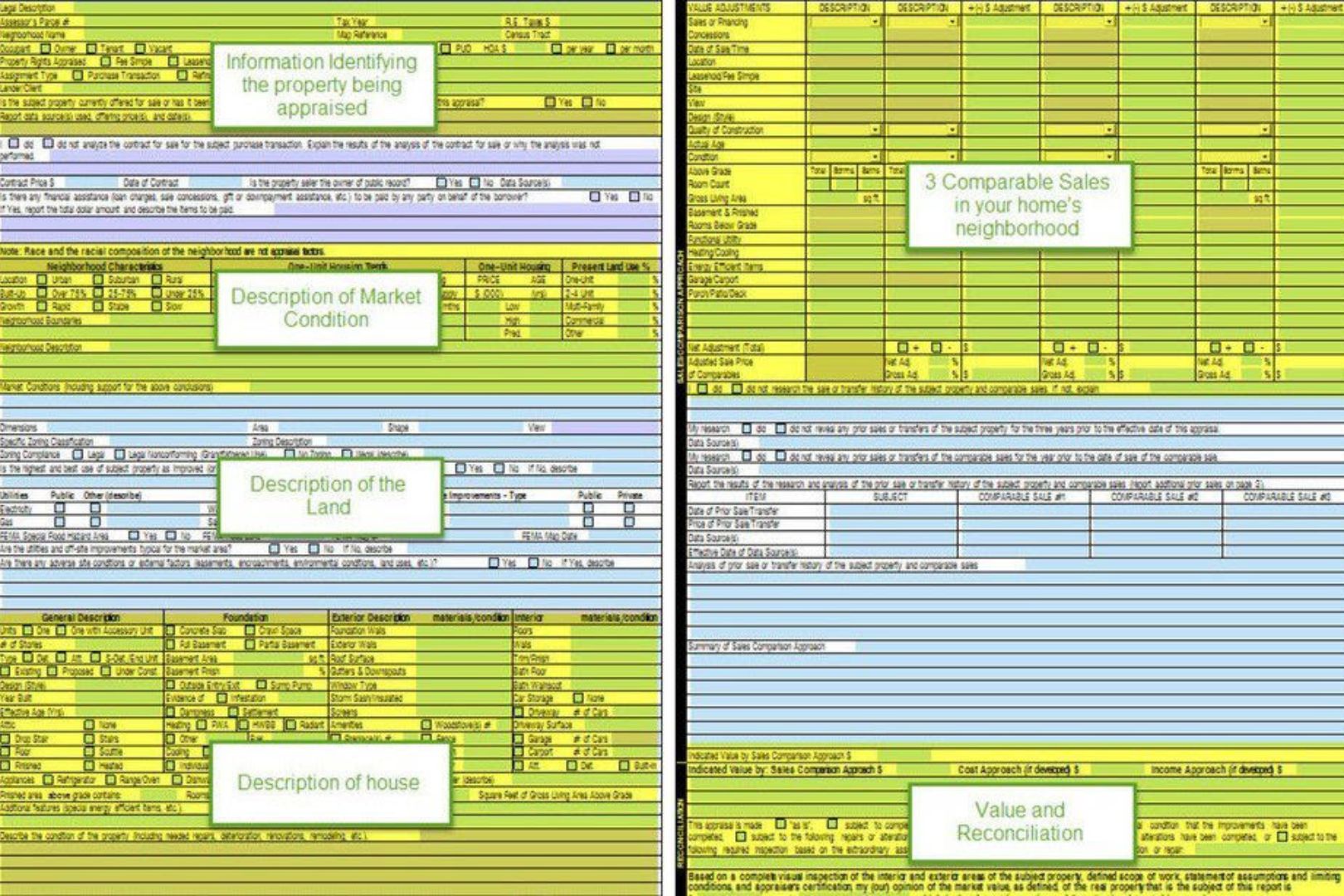

First, you’ve got the ‘Subject’ section. This is where you’ll find information about the property in question. It’s the ‘who’ and ‘where’ of the report. Details like the property address, legal description, and owner’s name are all nestled in here.

Next up is the ‘Contract’ section. If there’s a sale going on, this is where you’ll find the details. Think purchase price, contract date, and the like. It’s the ‘what’ and ‘when’ of the report.

Then we’ve got the ‘Neighborhood’ section. This is where the appraiser paints a picture of the area surrounding the property. It’s the ‘context’ of the report, giving you a snapshot of the local real estate market and the broader forces at play.

The ‘Improvements’ section is next in line. This is where the property itself comes under the microscope. Everything from the home’s condition to its unique features is laid out here. It’s the ‘how’ of the report, showing you what the property has (or doesn’t have) going for it.

Finally, we have the ‘Valuation’ and ‘Reconciliation’ sections. This is where the rubber meets the road. After considering all the data, the appraiser provides an estimated market value for the property and explains how they arrived at that figure. It’s the ‘why’ and ‘so what’ of the report, tying everything together.

FYI the Valuation sections encompasses the Sales Comparison Approach, the Income Approach and the Cost Approach.

Now, let’s talk key terms. ‘Subject’, ‘Contract’, ‘Neighborhood’, ‘Improvements’, ‘Valuation’, ‘Reconciliation’ – these are your new best friends. Get to know them, understand them, and you’ll be well on your way to mastering the art of reading appraisal reports.

Remember, knowledge is power. The more you understand the basics, the better equipped you’ll be to navigate the complex world of real estate appraisals. It’s not rocket science, but it does require a bit of dedication. Are you up for the challenge?

Tip 2: Understand the Purpose of the Appraisal

So, you’ve got the basics down. Great! But let’s not stop there. Why is the appraisal being done in the first place? Knowing the ‘why’ can provide a whole new perspective on the ‘what’.

There are several reasons an appraisal might be ordered. Maybe it’s for a home sale, or a refinancing deal. Maybe it’s for an estate settlement or a divorce settlement. Each purpose has its own unique considerations that can impact the final appraisal report.

Let’s say the appraisal is for a home sale. The main objective here is to determine if the contract price is in line with market realities.

On the other hand, an appraisal for a estate settlement may focus more on the market value as of “date of death”, which might not necessarily align with the current market value.

Why does this matter? Because the purpose of the appraisal can directly influence the report. It can affect the approach the appraiser takes, the comparables they select, and the adjustments they make.

In essence, understanding the ‘why’ behind the appraisal can help you better understand the ‘what’ in the report. It’s not just about reading the numbers, it’s about comprehending the story those numbers are telling.

So next time you’re handed an appraisal report, take a moment to ask – why was this appraisal done? The answer might just change the way you read the report.

Tip 3: Pay Attention to the Comparables

Alright, let’s chat about comparables, or “comps” as they’re often called in the biz. These are properties similar to the one being appraised that have recently sold or are currently on the market. They play a key role in determining the appraised value of a property. Think of them as the yardstick by which your property is measured.

The comparables are analyzed in the Sales Comparison Analysis section of an appraisal report. This section can seem like a jumble of numbers and terms, but it’s not as daunting as it looks.

Here’s the lowdown: each comp is listed with its selling price, and various features such as location, size, age, condition, and amenities. These features are compared to those of the property being appraised, and adjustments are made to the comp’s selling price based on the differences.

So, how do you make sense of this section? Here’s a tip: don’t get too caught up in the individual adjustments. Instead, look at the big picture. Are the comps similar to your property? Are they in the same neighborhood? Do they have similar features? If the answer is yes, then the appraised value is likely on point.

But if the comps seem off – maybe they’re in a different neighborhood, or they’re significantly larger or smaller – that could be a red flag. Remember, comps are a major factor in determining the appraised value. If they’re not truly comparable, the value could be skewed.

So, keep a keen eye on the comparables. They’re more than just numbers on a page – they’re a crucial piece of the appraisal puzzle.

Tip 4: Review the Adjustments

So, you’ve got your hands on an appraisal report and you’re cruising through the comparables. You’re feeling good, feeling confident. But then, you hit the adjustments section and suddenly, it’s like you’ve run into a brick wall. Don’t worry, it’s not as daunting as it seems. Let’s break it down.

Adjustments, in the simplest terms, are like the tweaks on a stereo equalizer. They’re used to level the playing field between the subject property and the comparables.

For instance, if a comparable property has a swimming pool and the subject property doesn’t, an adjustment is made to account for this difference. This ensures that you’re comparing apples to apples, not apples to oranges.

But how do you interpret this section? Well, it’s not about just looking at the numbers. It’s about understanding the story those numbers tell.

When you see a negative adjustment, it means the comparable is superior to the subject property in that aspect. A positive adjustment, on the other hand, indicates the subject property is superior.

Pro Tip

CBS – Comparable Better? – Subtract!

CIA – Comparable Inferior? – Add!

The key here is to not get lost in the figures. Instead, try to understand the rationale behind each adjustment. Why was it made? How does it affect the overall value? Remember, each adjustment is a piece of the puzzle that forms the final appraisal value.

Now, you might be wondering, “What if I disagree with an adjustment?” That’s a valid concern. The key questions is: “Is the adjustment market based? – Is it supported by evidence?

The appraisers support for his or her adjustments should be noted in the comments or addenda. Understand their perspective and use that knowledge to better serve your clients.

So next time you’re faced with the adjustments section, don’t panic. Take a deep breath, review each adjustment carefully, and try to see the story behind the numbers. It might take some practice, but once you get the hang of it, you’ll be able to navigate this section like a pro.

Tip 5: Don’t Ignore the Conditions and Assumptions

This section isn’t just small print. It’s the equivalent of the secret sauce in a gourmet recipe. Ignore it at your peril. The conditions and assumptions section of an appraisal report often gets sidelined, but it’s a crucial part of the whole narrative. It’s like the director’s commentary on a movie. You get to understand the ‘why’ behind the ‘what’.

Why is it so important? It’s because this section outlines the terms under which the appraisal was made. It’s a list of all the factors that the appraiser assumed to be true when determining the value of the property.

This could include anything from zoning laws to the physical condition of the property. It’s the lens through which the appraiser viewed the property, and it can significantly impact the final appraisal value.

Think of it like this: you’re a detective, and this section is a vital clue that helps you piece together the full picture. If you don’t consider these conditions and assumptions, you might end up with a distorted understanding of the property’s value.

So, how do you navigate this section? Start by reading it carefully. Don’t skim. Each assumption or condition is a piece of the puzzle. If something seems off or doesn’t make sense, flag it. Ask questions. Challenge assumptions.

Remember, your job is to get a complete and accurate understanding of the property’s value. You can’t do that if you’re working with incomplete or inaccurate information.

The conditions and assumptions are not just a footnote. It’s a crucial part of the appraisal report that deserves your full attention. Ignore it at your own risk.

Unfortunately, assumptions can be written anywhere in the report, but they are required to be prominent wherever they are placed.

Tip 6: Look for Errors

It’s a little-known secret that even appraisal reports, as official as they may seem, can be prone to human error. And while it’s not exactly like hunting for Waldo, spotting these mistakes requires a keen eye and a solid understanding of the appraisal process.

Common errors can range from minor typos to major miscalculations. They might be as simple as misspelled names and incorrect property addresses, or as significant as erroneous square footage calculations and inaccurate comparable sales data. These mistakes, while they might seem trivial, can have a profound impact on the final appraisal value.

So, how do you play detective with an appraisal report? First, don’t rush. Take your time to thoroughly review each section of the report.

Pay special attention to the property description and the comparable sales used. Ensure the information aligns with what you know about the property and the local market.

Second, question everything. Does the reported square footage match your records? Do the comparable sales seem appropriate? If something seems off, it probably is.

Lastly, don’t hesitate to reach out to the appraiser for clarification. Remember, it’s not about challenging their expertise but about ensuring accuracy. After all, we’re all human and mistakes do happen.

Looking for errors isn’t about being nitpicky—it’s about safeguarding your client’s interests and maintaining the integrity of the transaction. So, put on your detective hat and start scrutinizing those appraisal reports.

Tip 7: Consult with the Appraiser

Ever heard the saying, “two heads are better than one?” It rings true in the world of real estate appraisals as well. The final, and arguably one of the most important, tips is to establish an open line of communication with the appraiser.

Why? Because appraisers are the masters of their craft, they hold a wealth of knowledge that can provide you with invaluable insights into the appraisal report.

Now, you might be thinking, “Great, but how do I approach this conversation without sounding like I’m questioning their expertise?” Good question. Here’s how.

Firstly, approach the conversation with genuine curiosity. You’re not there to challenge their appraisal, but to understand it. Ask them to explain the reasoning behind their choices, particularly if something isn’t clear to you.

A phrase like “Could you help me understand why this particular comparable was chosen?” comes across as much more collaborative than confrontational.

Secondly, make it a two-way street. Share your knowledge about the property and its neighborhood. You might have information that the appraiser wasn’t aware of, like upcoming developments in the area or recent sales that weren’t listed publicly. This can be incredibly beneficial to both parties.

Finally, remember to respect their time and expertise. Appraisers are busy professionals, so keep your questions concise and to the point.

And remember, while it’s okay to ask for clarification, it’s not okay to pressure an appraiser to change their valuation. Their independence and objectivity are crucial aspects of their role.

In a nutshell, don’t be a stranger to the appraiser. A little bit of communication can go a long way in helping you understand an appraisal report. Plus, it can strengthen your professional relationships, making future appraisals a smoother process.

Conclusion

Alright, so we’ve covered a fair bit of ground here. Let’s take a moment to circle back and recap the seven pointers that can make reading appraisal reports less of a headache and more of a breeze for you.

First off, get your head around the basics. Know the structure, understand the key terms. Next, grasp the purpose of the appraisal. It’s not just numbers and figures; there’s a story behind it all. Then, give due attention to the comparables and adjustments. They’re not just fillers; they play a significant role in the valuation.

Also, don’t let your eyes glaze over the conditions and assumptions section. It’s not just fine print; it can seriously impact the appraisal value. And while you’re at it, be on the lookout for errors. They’re not just typos; they can skew the entire report.

Lastly, don’t hesitate to reach out to the appraiser. They’re not just report generators; they can provide valuable insights and clarifications.

Well, we’ve come to the end. I really hope this guide has helped you to understand appraisal reports better. If I can be of service to you as you navigate the world of appraisals, please reach out. I am always happy to help.

Keep learning, keep growing, and keep rocking the real estate world!